Learn to Build the Future of Internet

Discover the next big thing in Creator Economy, AI, SaaS, Web3 & Consumer Tech. Trends, startup ideas & databases for founders, VCs and analysts.

Online Communities: How We Learn, Earn & Socialize →

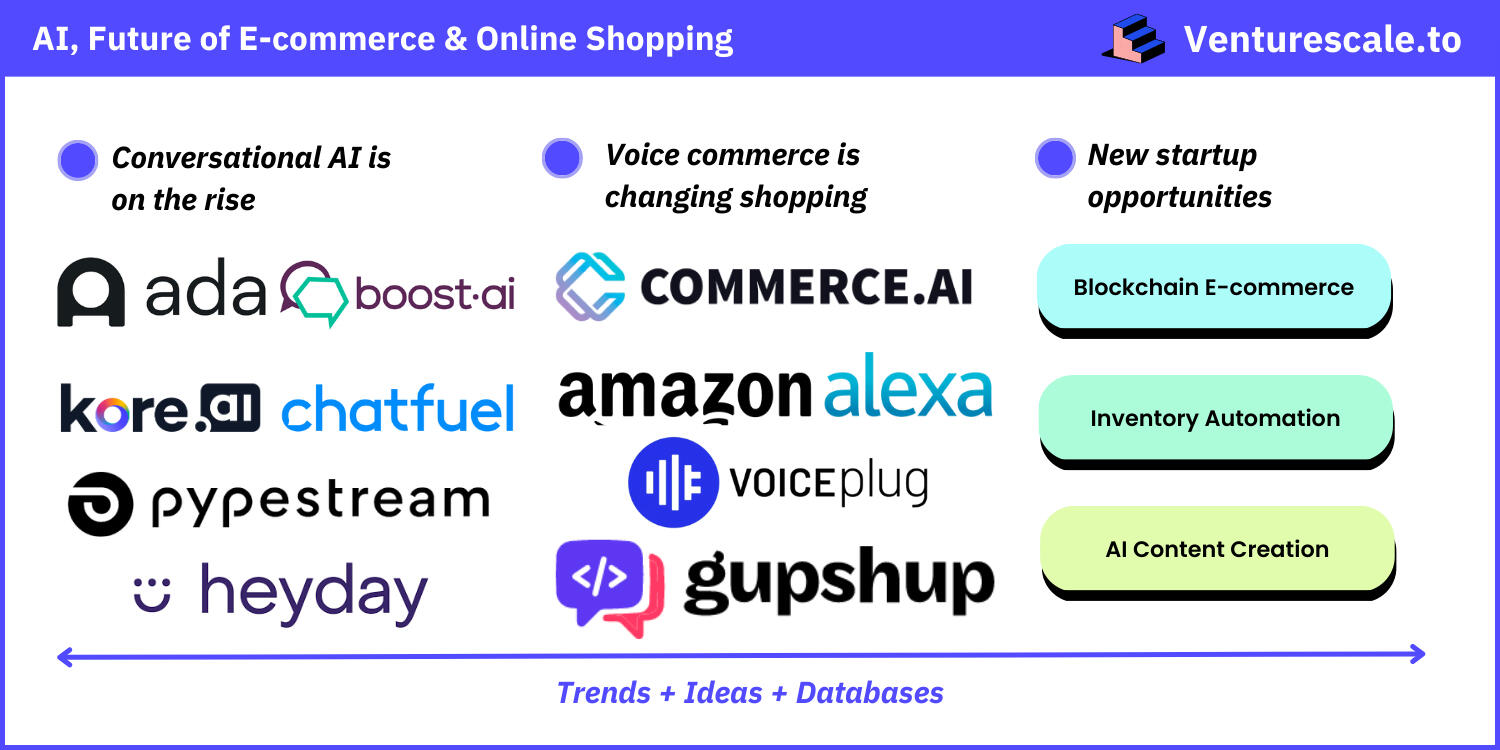

AI, E-commerce, Online Shopping, Conversational AI, Visual Commerce, AI Visual Search

AI, Future of E-commerce & Online Shopping →

AI, E-commerce, Online Shopping, Conversational AI, Visual Commerce, AI Visual Search

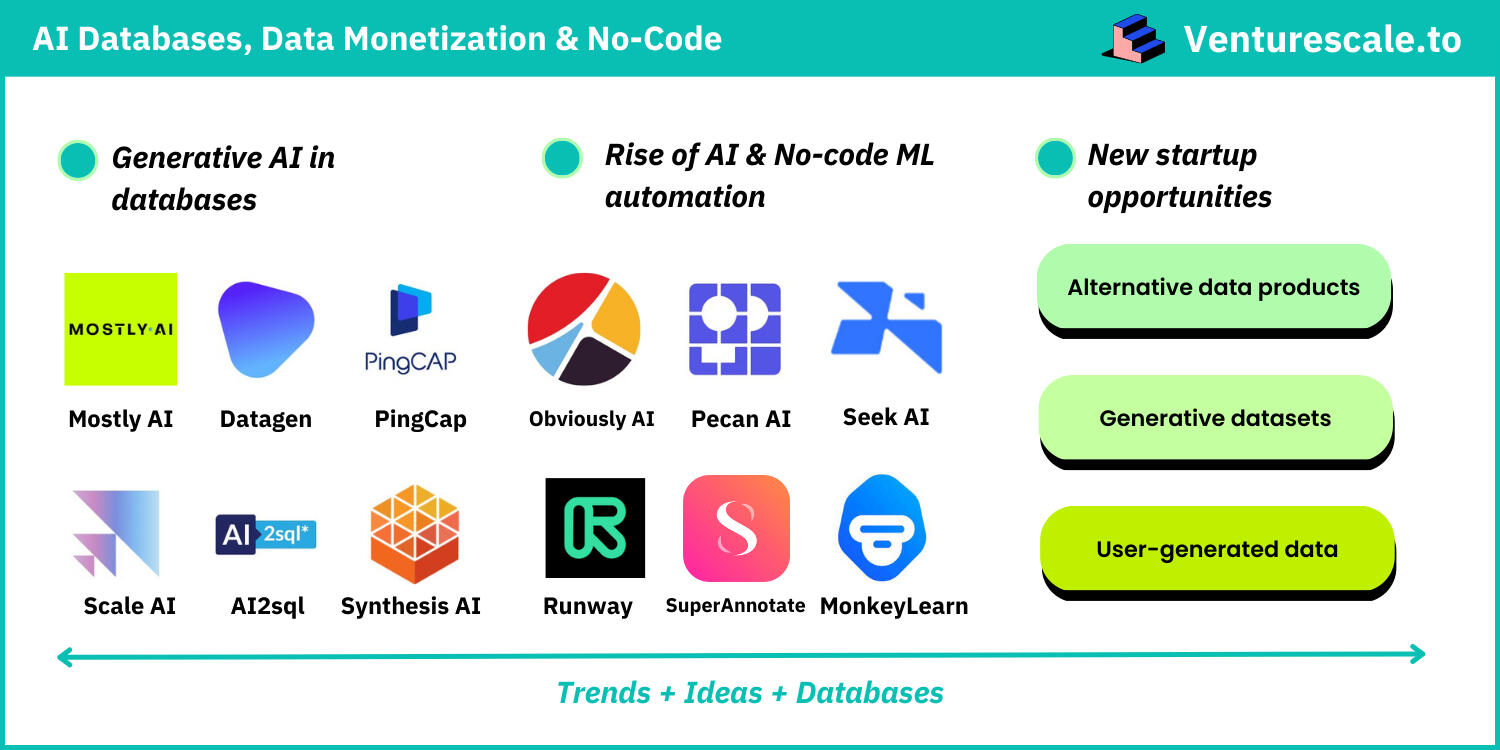

AI Is Creating The New Data Monetization Opportunity →

AI, No-Code, Generative AI, Data Economy, Machine Learning, Automation, AI Prediction

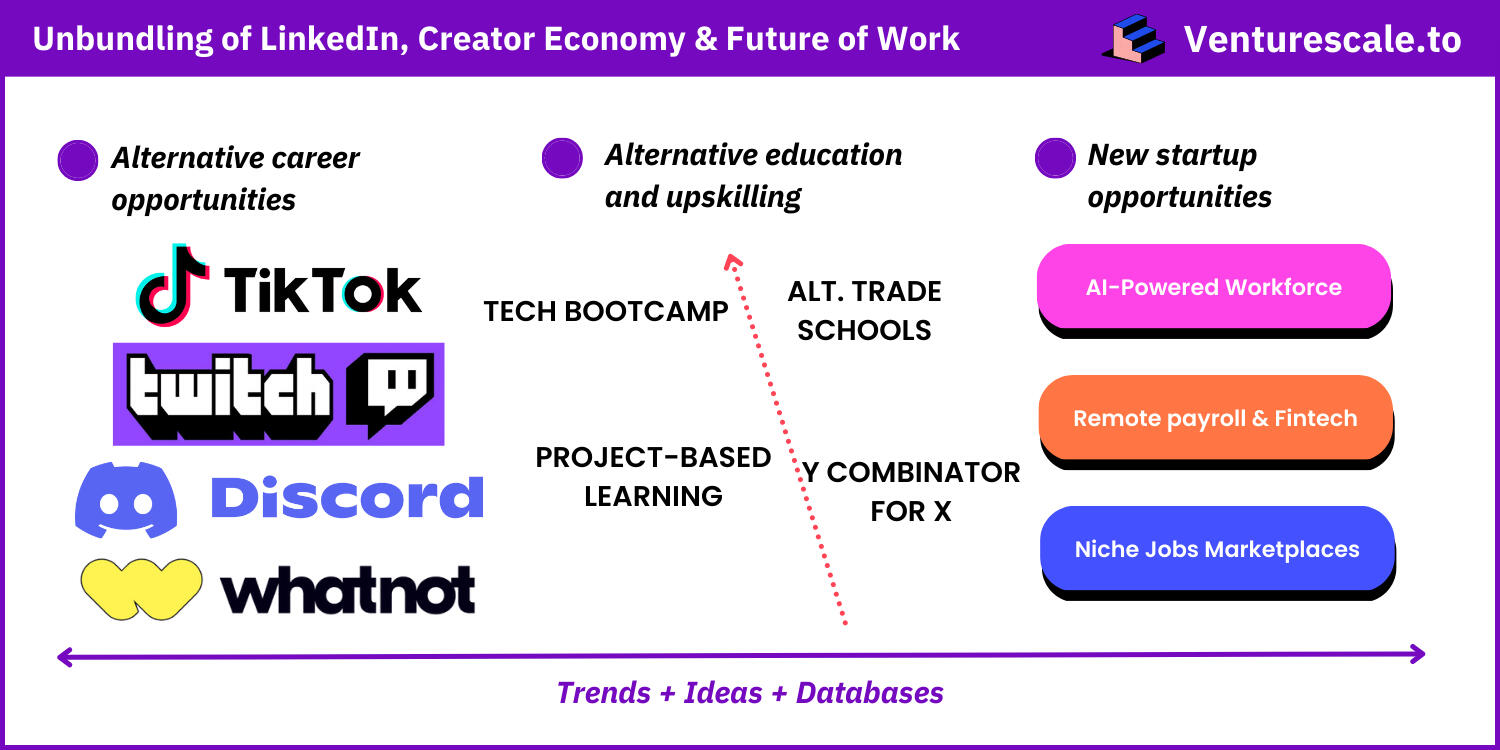

Unbundling of LinkedIn & the New Creator Economy →

LinkedIn Unbundle, Future of Work, Digital Native Economy, Creator Economy, Ecommerce

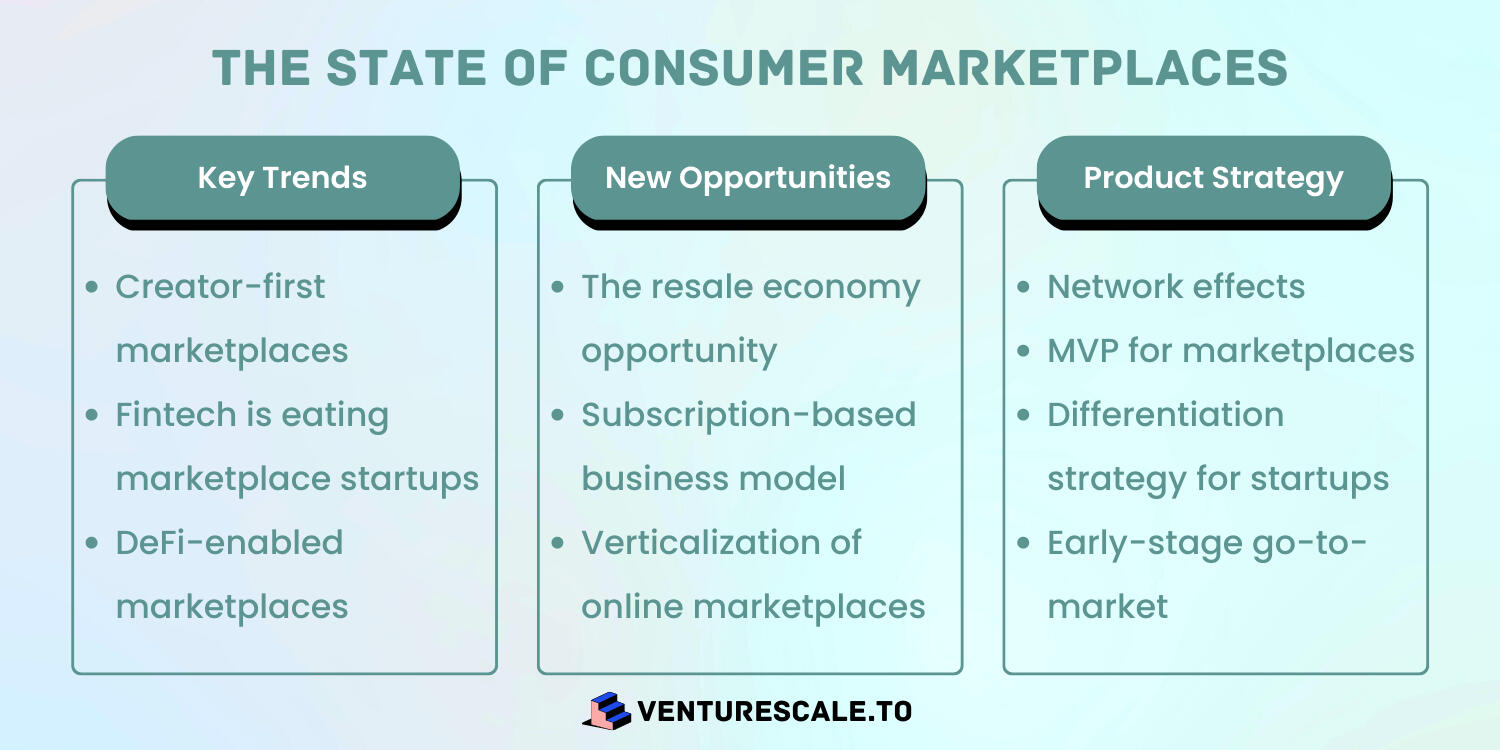

The Next Consumer Marketplace Business Models →

Consumer, Online Marketplaces, Creator-Led Platforms, Service Marketplace, Knowledge Economy, Business Models

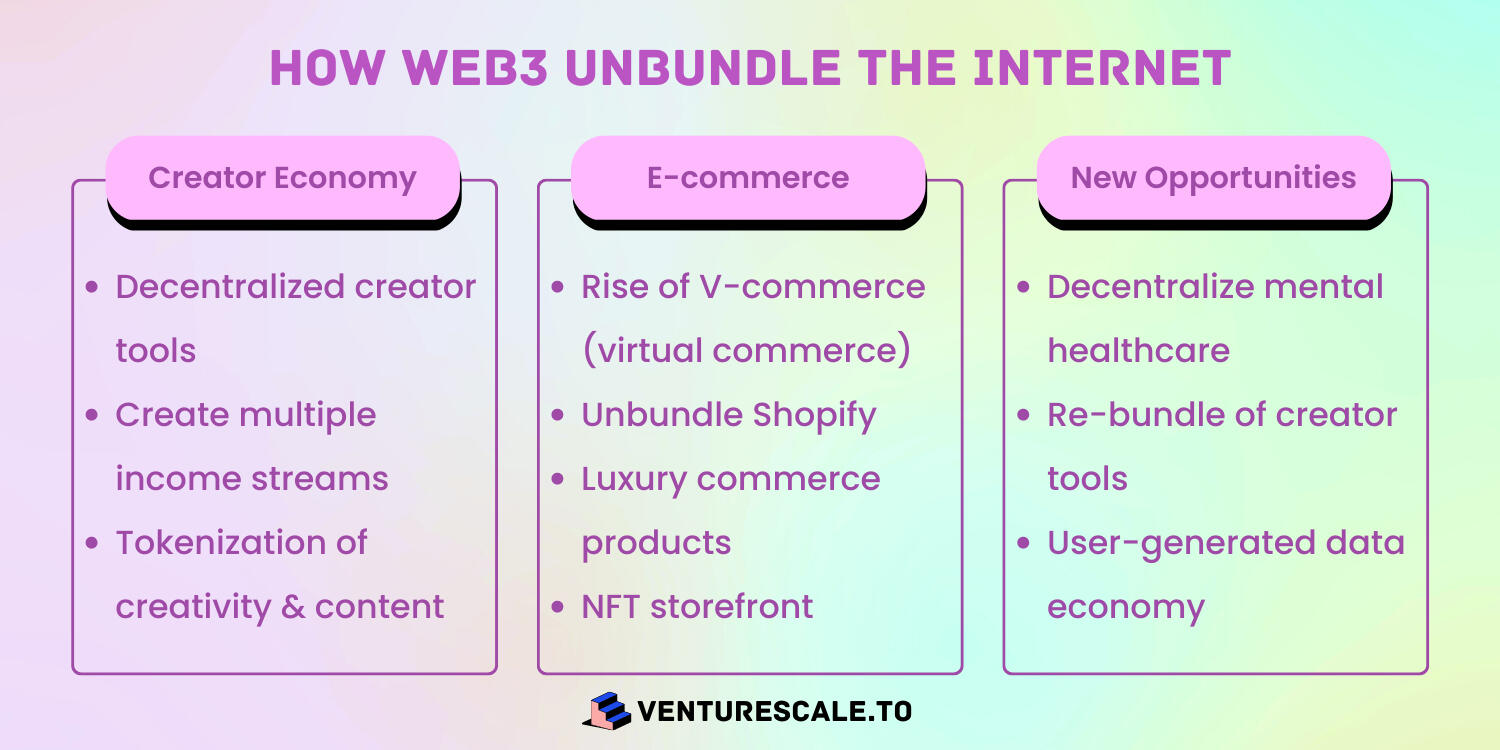

The Great Web3.0 Unbundling & Future of Internet Products →

Web3, Unbundling, Internet Companies, Creator Economy, Future of E-Commerce, Digital Identity

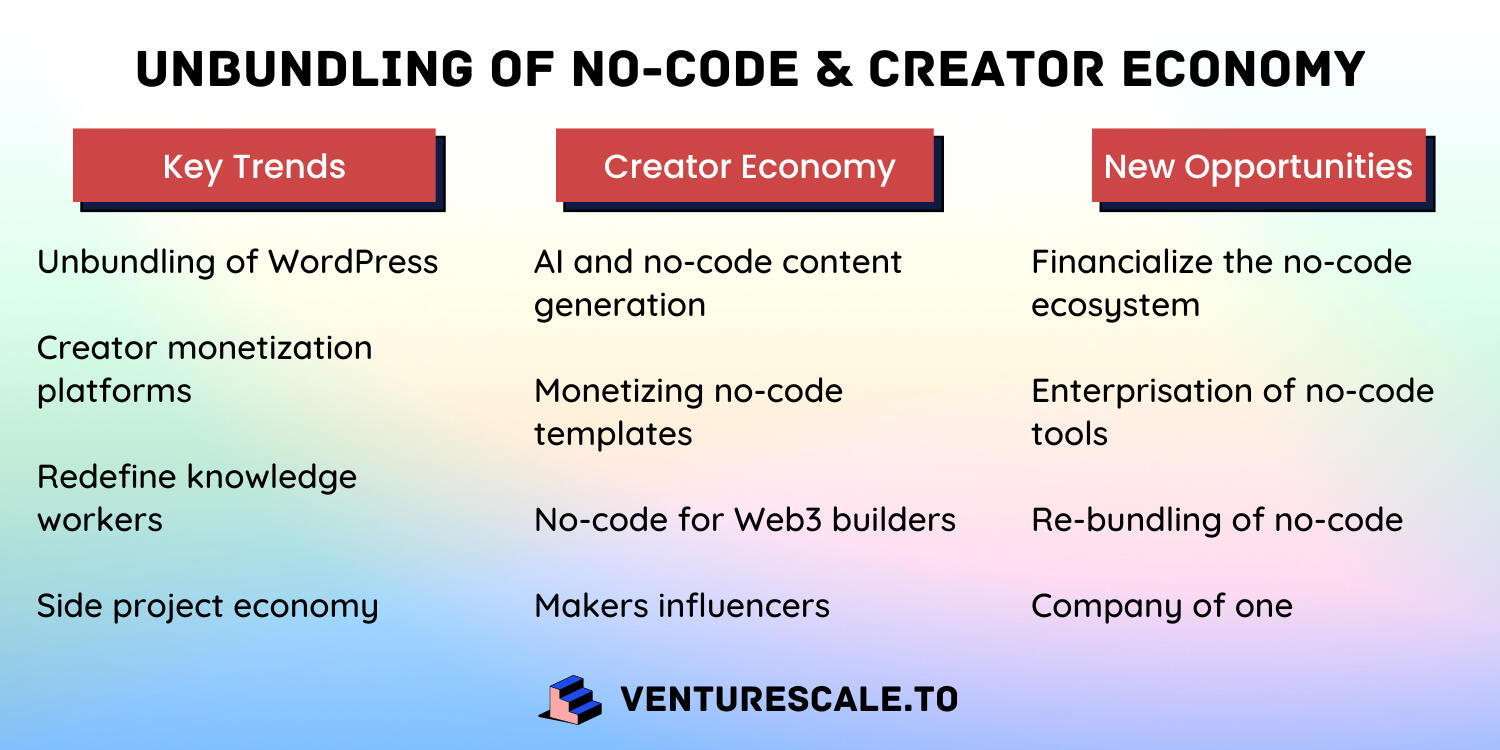

How to Unbundle WordPress: State of No-Code Economy →

No-Code, Creator Economy, Creator Monetization, Unbundling, Re-Bundling, WordPress, Web3 Creators, Knowledge Workers,

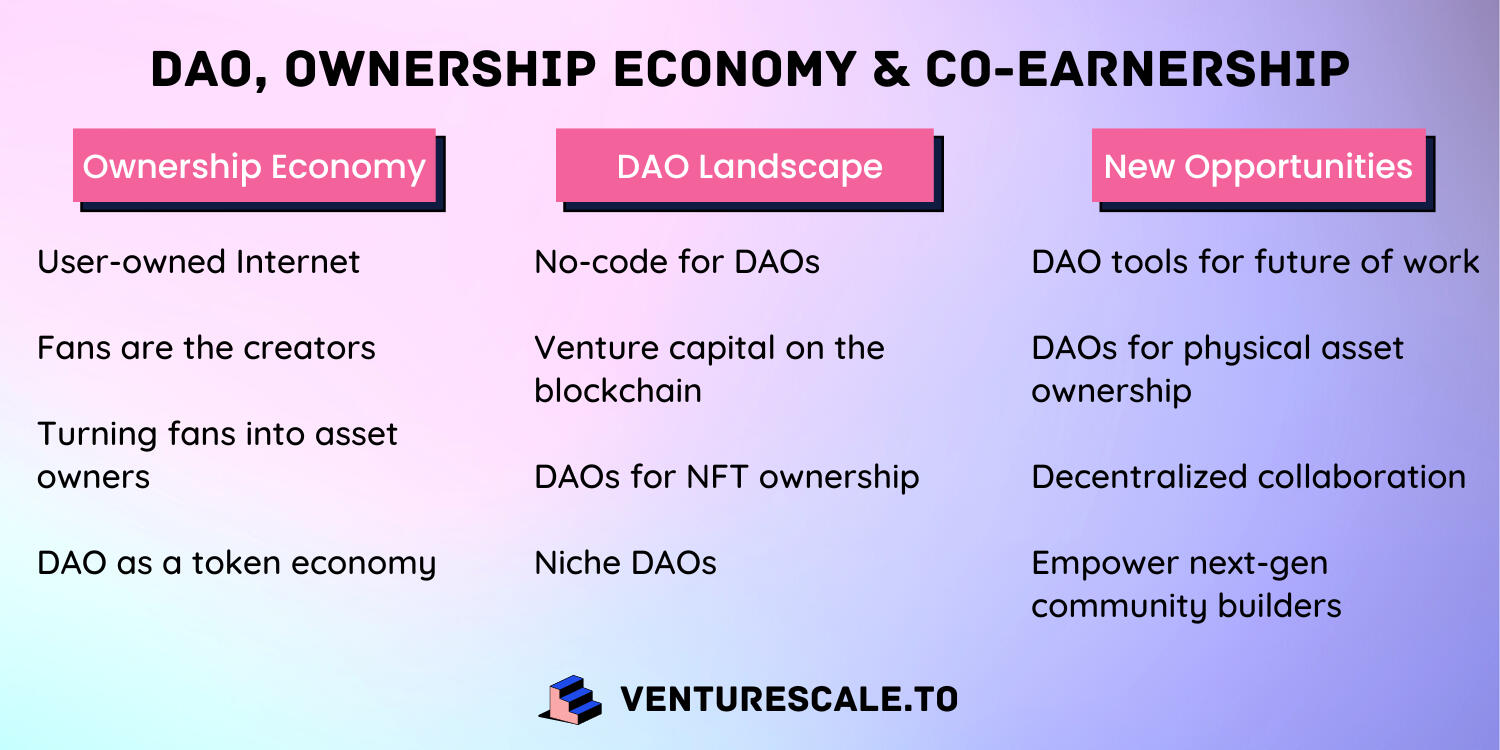

DAOs: The Ownership Economy & Co-Earnership Model →

DAO, Web3 Community, Ownership Economy, Future of the Internet, Co-Ownership, Venture Capital, Decentralized Science

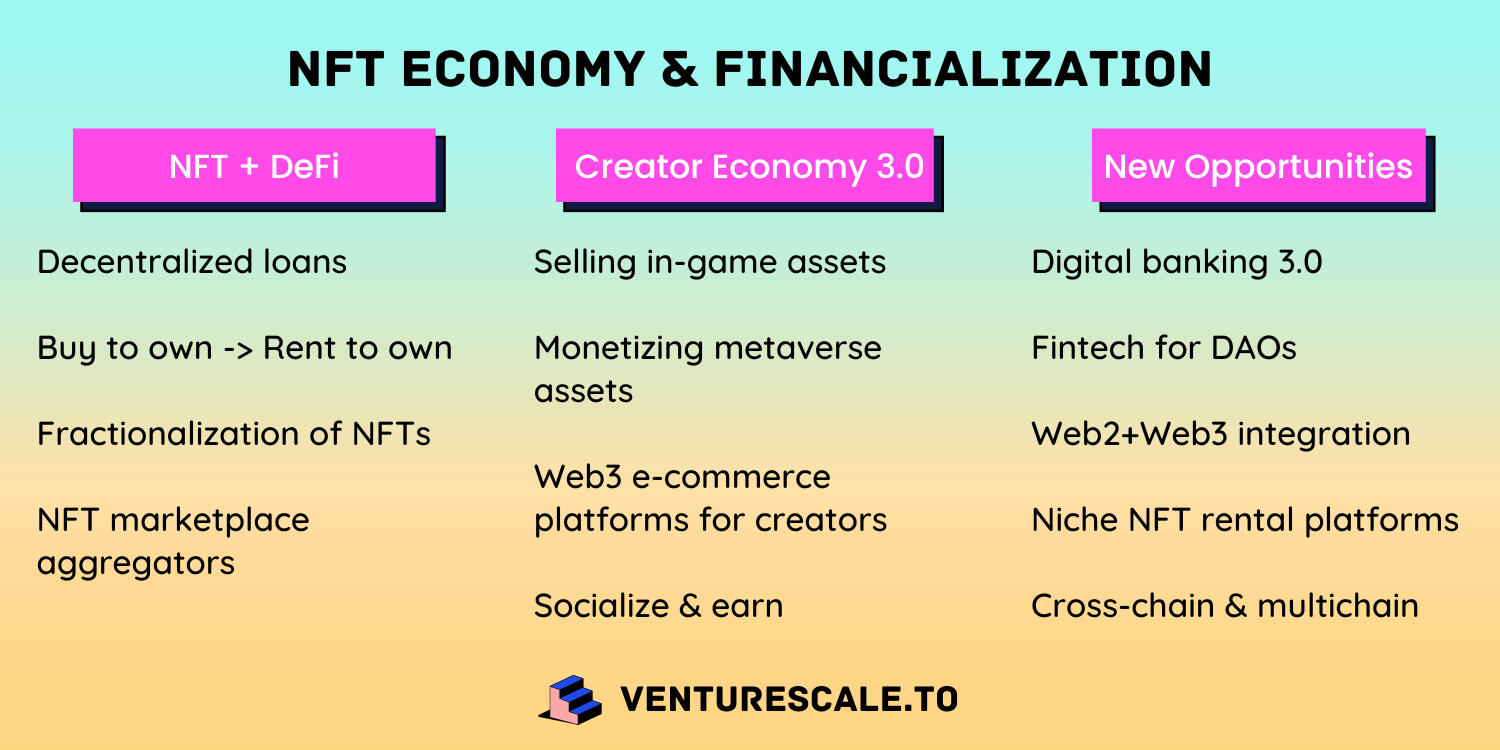

NFT Renting, Financialization & Airbnb for Metaverse →

NFT Economy, DeFi, Decentralized Finance, Web3, Financialization, NFT Lending, NFT Marketplace

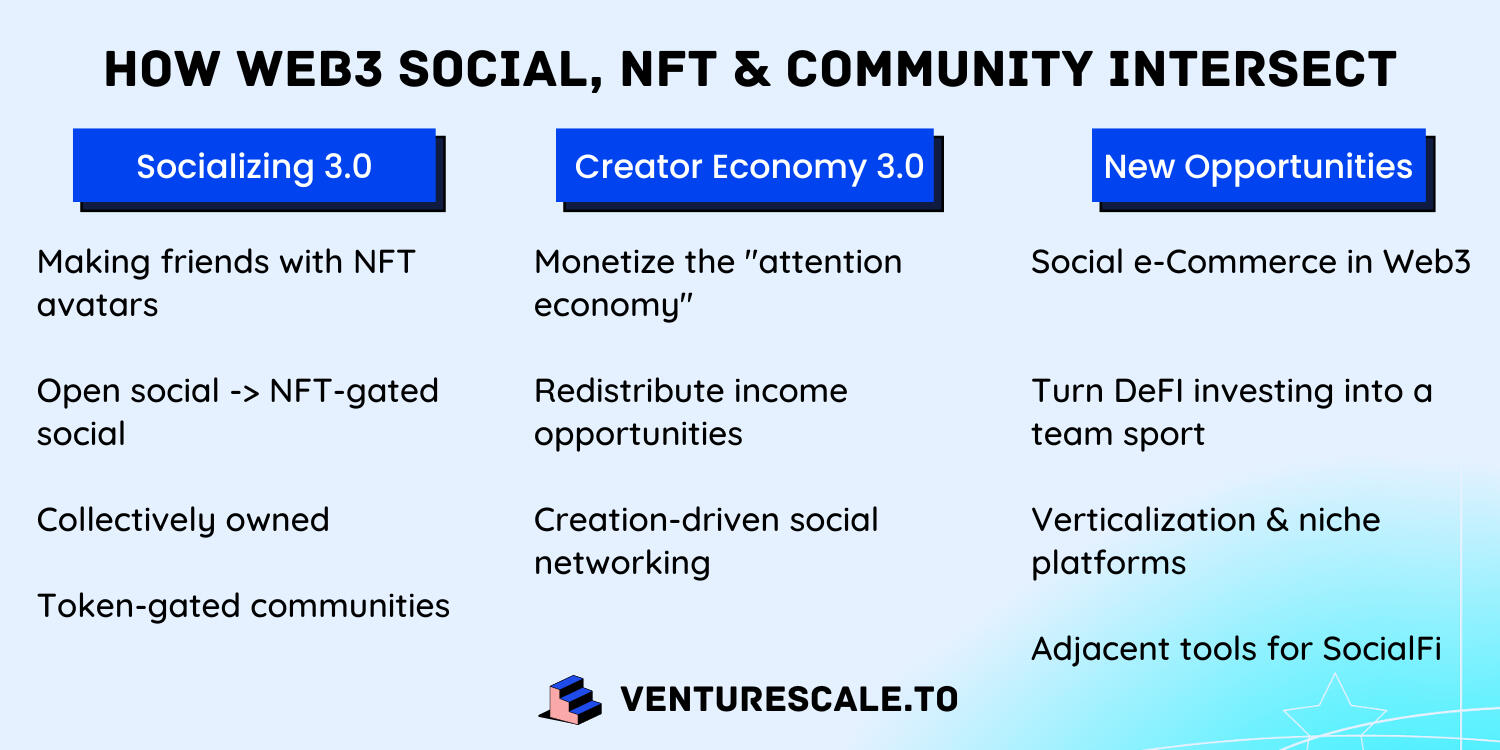

Web3.0 Creator Economy, NFT & Community →

Web3 Social, Crypto, SocialFi, DeFi, NFT, Decentralized Social, DAOs, Online Community

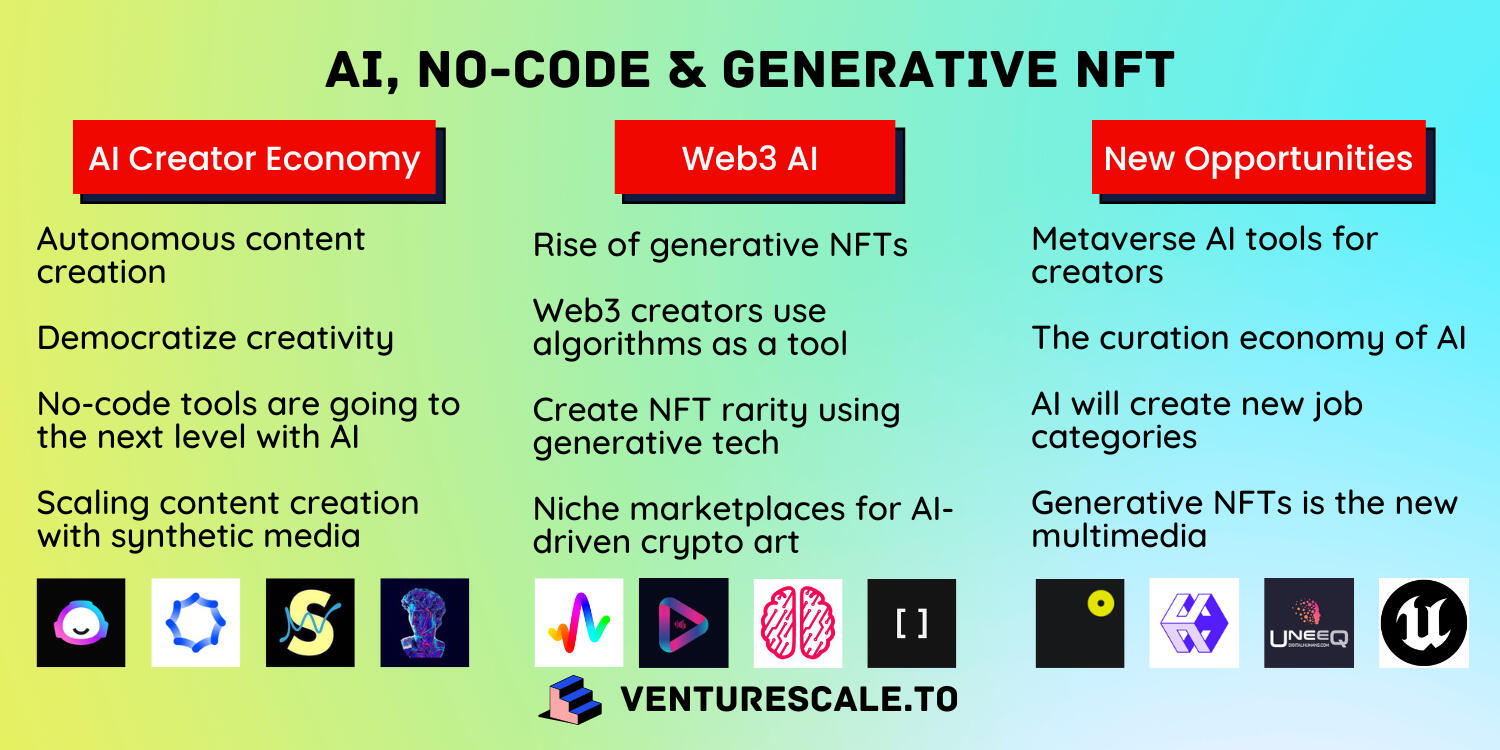

AI, No-Code & Generative NFTs: The Creator Economy of AI →

Artificial Intelligence, AI Creator Economy, Generative Tech, Generative NFTs, Automation, No-Code, Machine Learning

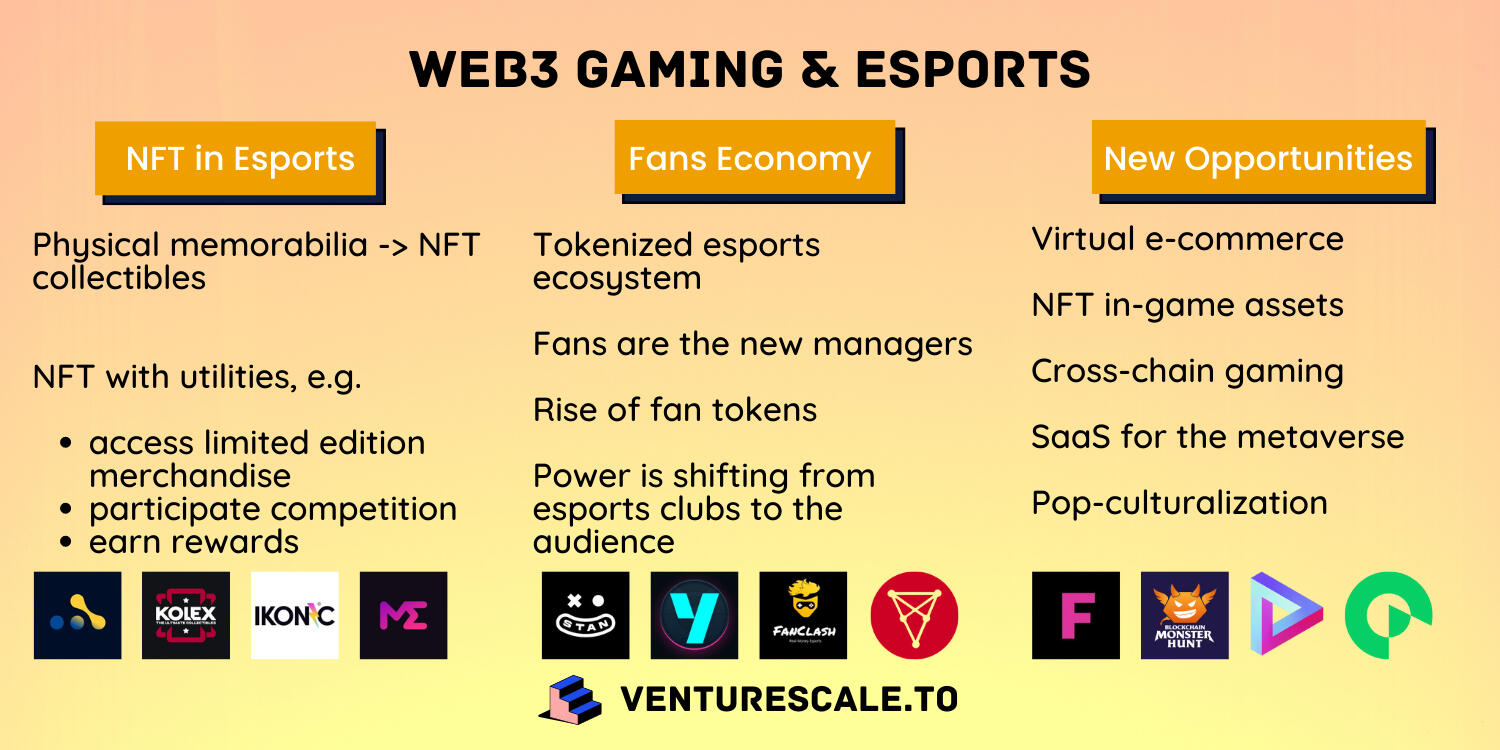

How Web3 & NFT creates New Opportunities in Esports & Gaming →

Esports, Video Games, Crypto Gaming, NFT Gaming, Gaming DAO, Gaming Creators, Creator Economy, Livestreaming

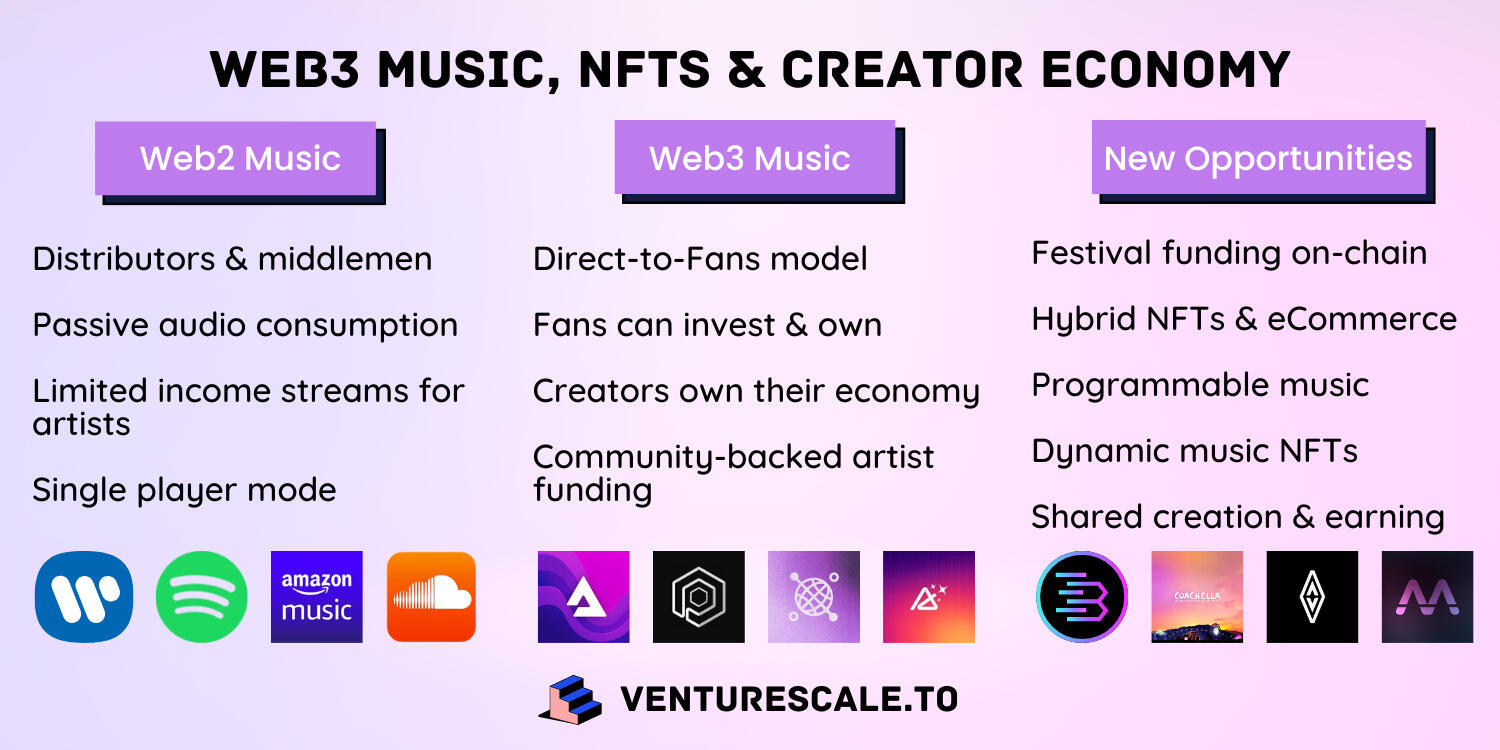

Web3 Music: NFTs, Creator Economy & Metaverse →

Music NFT, Audio Apps, Musicians, Creator Economy, Crypto, Web3, Blockchain, Listen-to-Earn

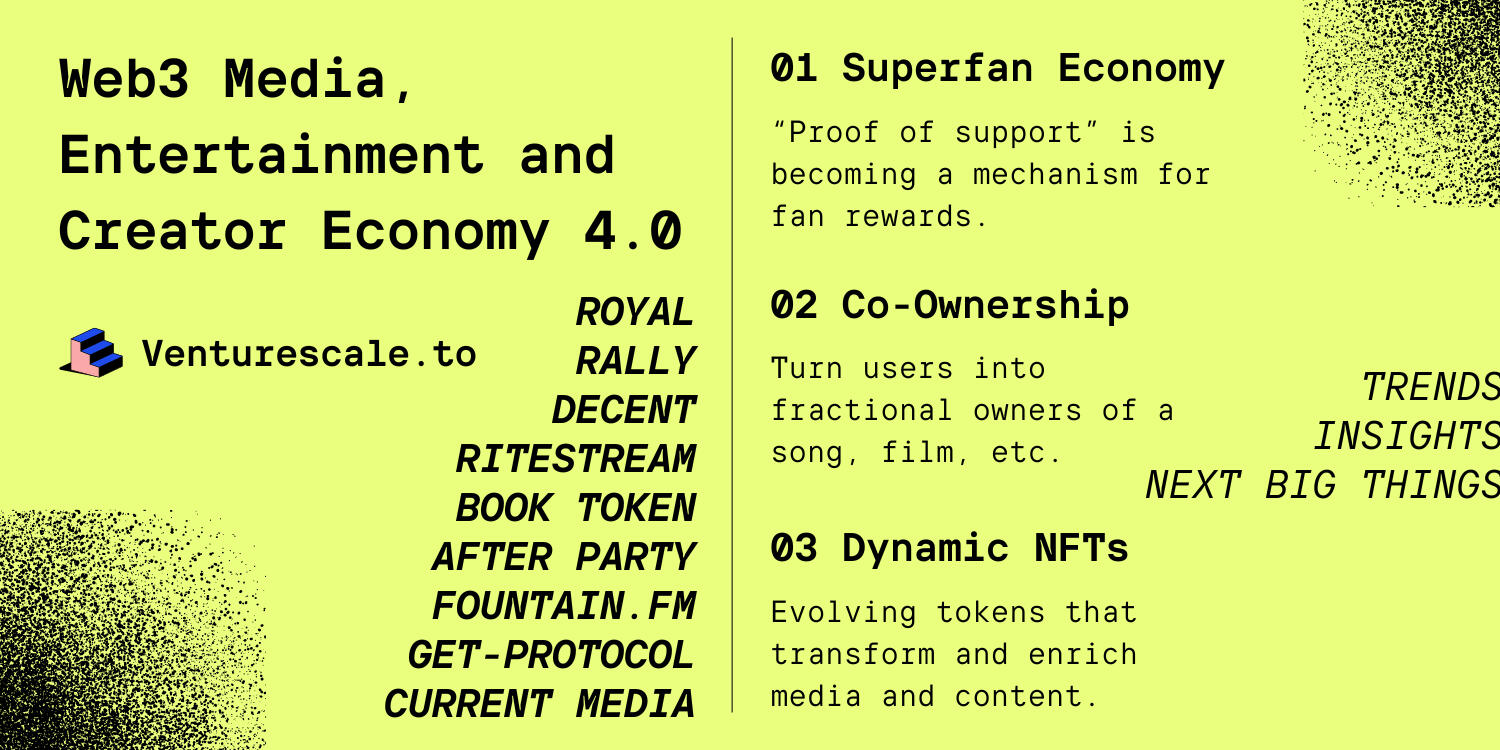

Web3 Media, Entertainment & Creator Economy 4.0 →

Web3 Media, Digital Content, Decentralized Film, Tokenization, NFT, Creator Economy, Token-Gating, Ownership Economy

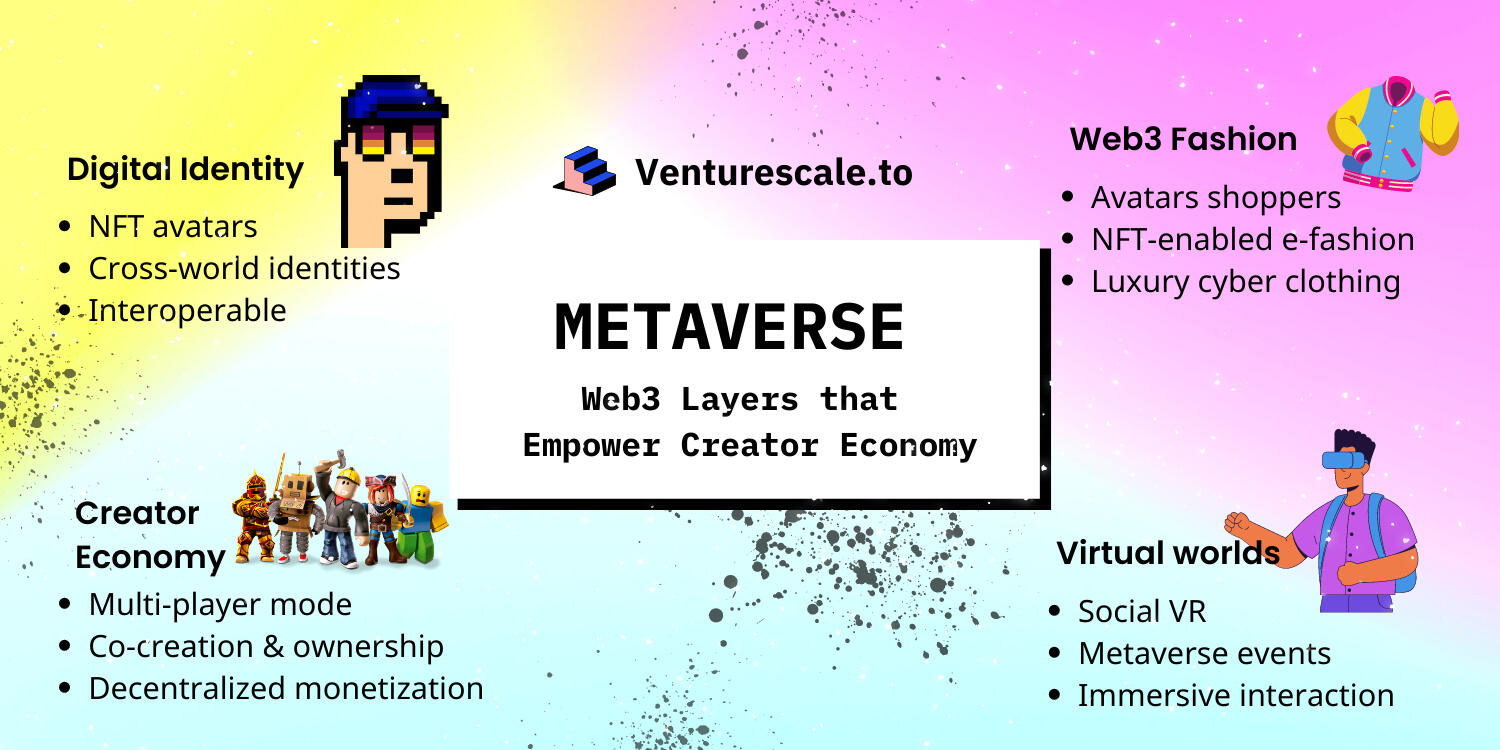

Metaverse & the Web3 Tools that Empower Creator Economy →

Web3 Media, Digital Content, Decentralized Film, Tokenization, NFT, Creator Economy, Token-Gating, Ownership Economy

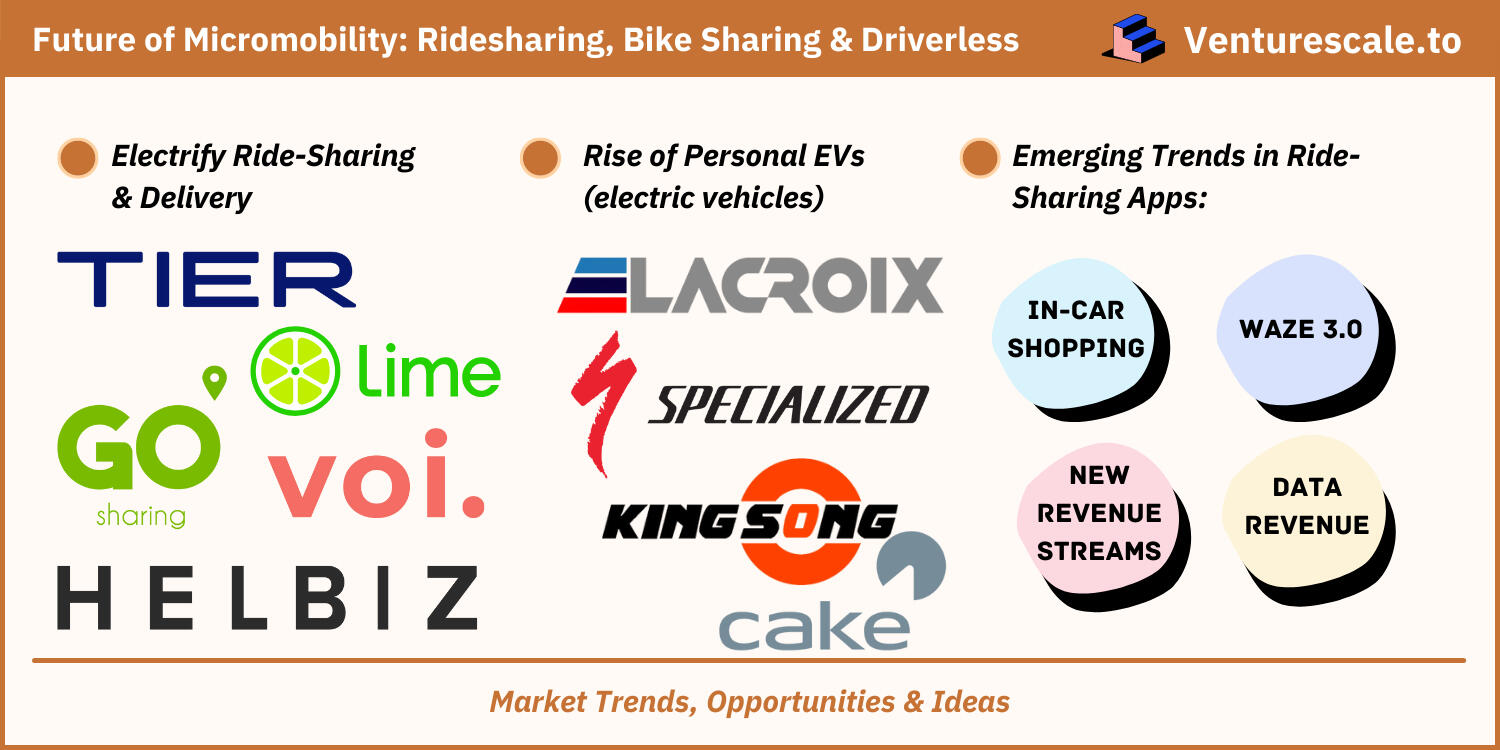

Ridesharing Apps, Personal EVs & Future of Urban Mobility →

Micromobility, Electric Vehicles, Ridesharing, E-Mobility, Urban Transportation, Autonomous Vehicles, In-Car Commerce

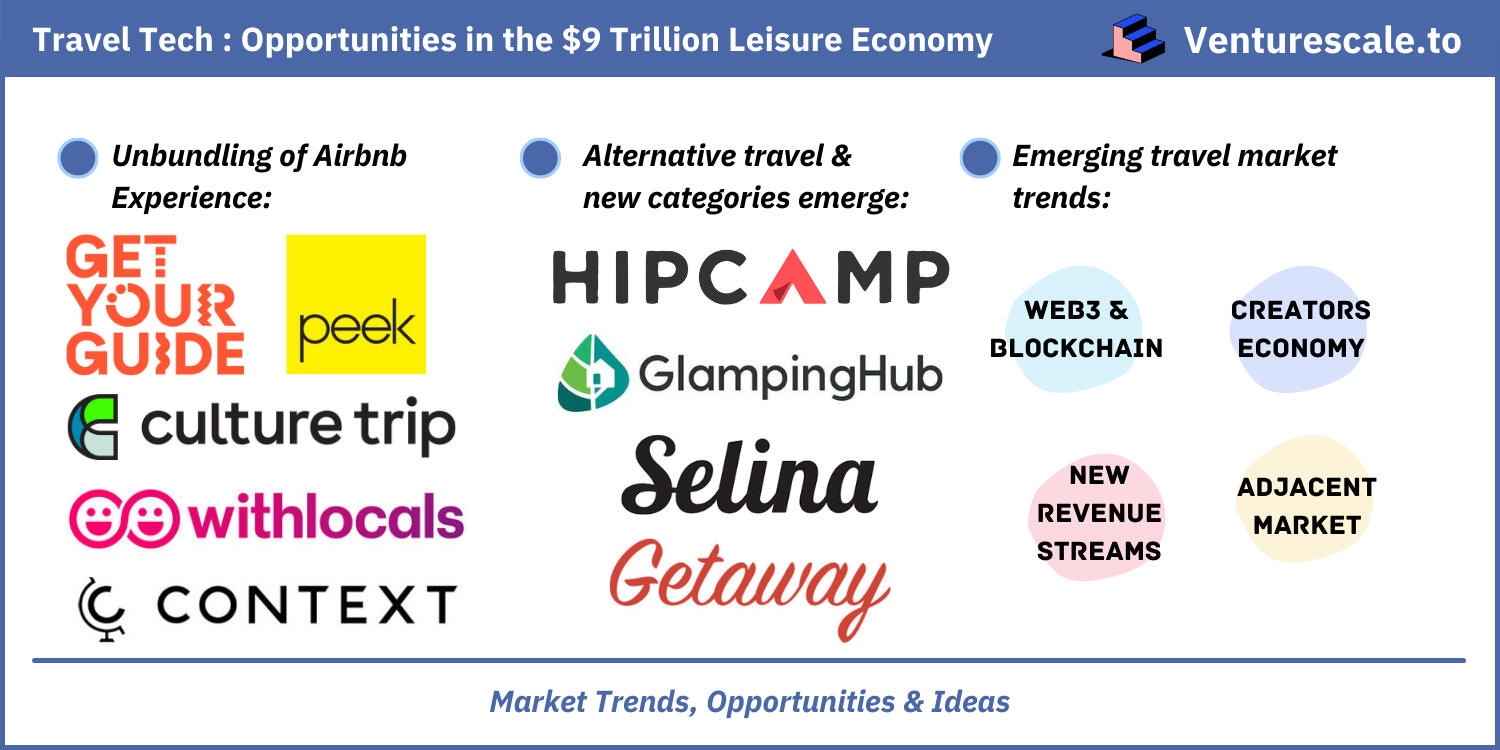

Unbundling Airbnb Experiences, Netflix for Travelers & Alternative Travel →

Travel Tech, Online Travel Agency, OTA, Tourism, Leisure Economy, Emerging Trends

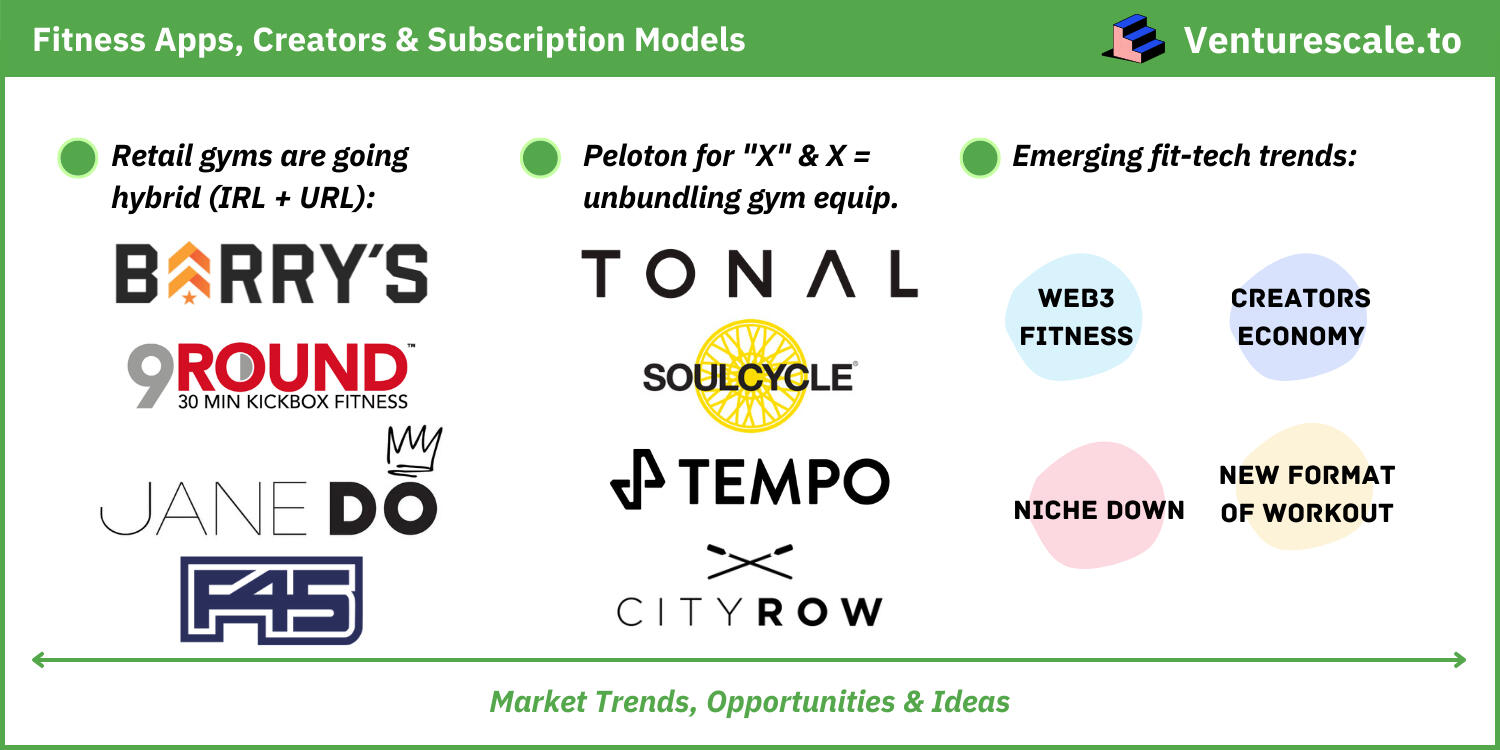

Creator Economy of Fitness, Peloton for “X” and Future of Fitness →

Creator Economy, Fitness Tech, Wellness Tech, Connected Gym Equipment, On-Demand Fitness, Livestream Fitness

Pet Tech & the Next Big Things for “Furry Consumers” →

Pet Tech, Smart Collar, Pet Industry, Business Models, E-Commerce, Pet Retailer, Pet Foods, Digital Health

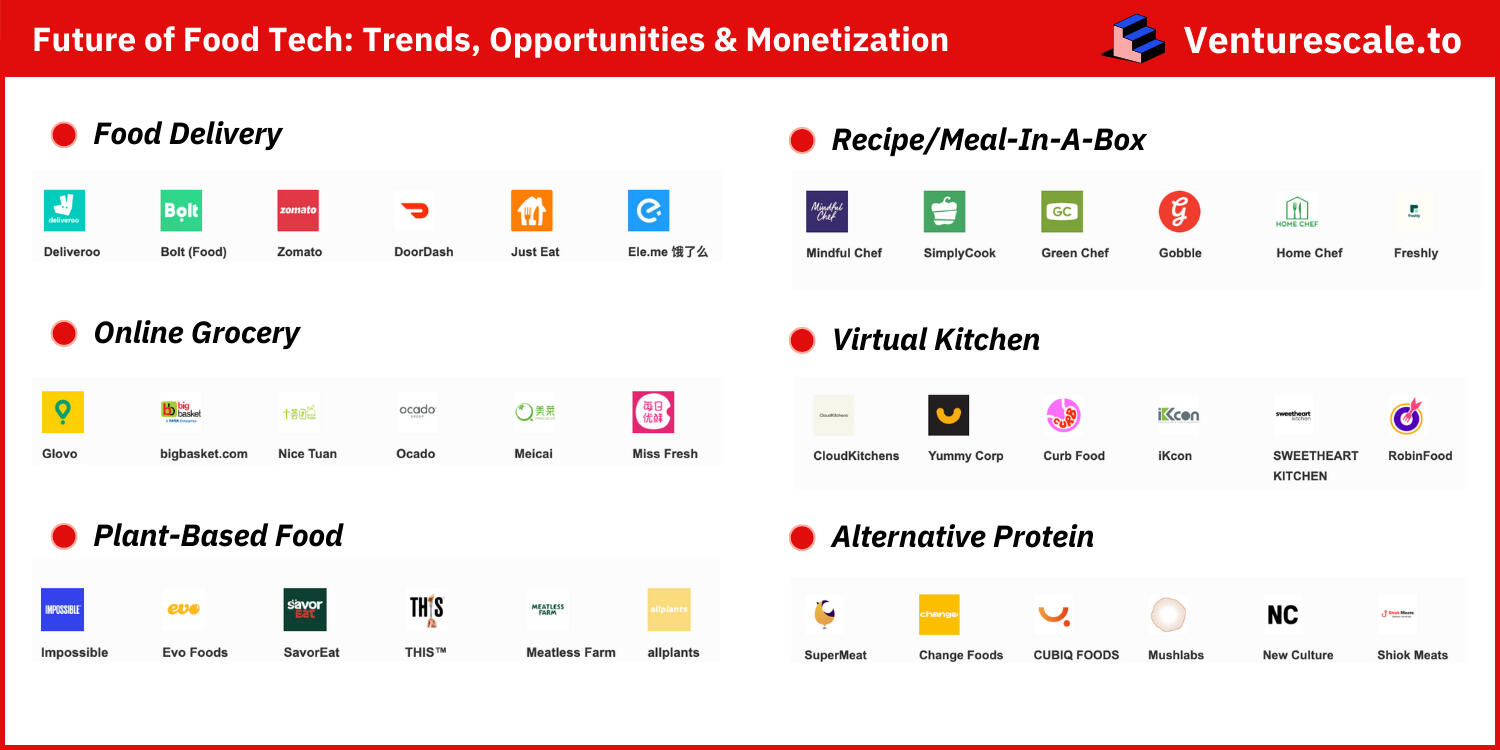

The Future of Food: How software feeds your stomach →

Food Tech, Food Industry, Online Grocery, Alternative Protein, Meal Kit Delivery, Food Delivery, Virtual Kitchen

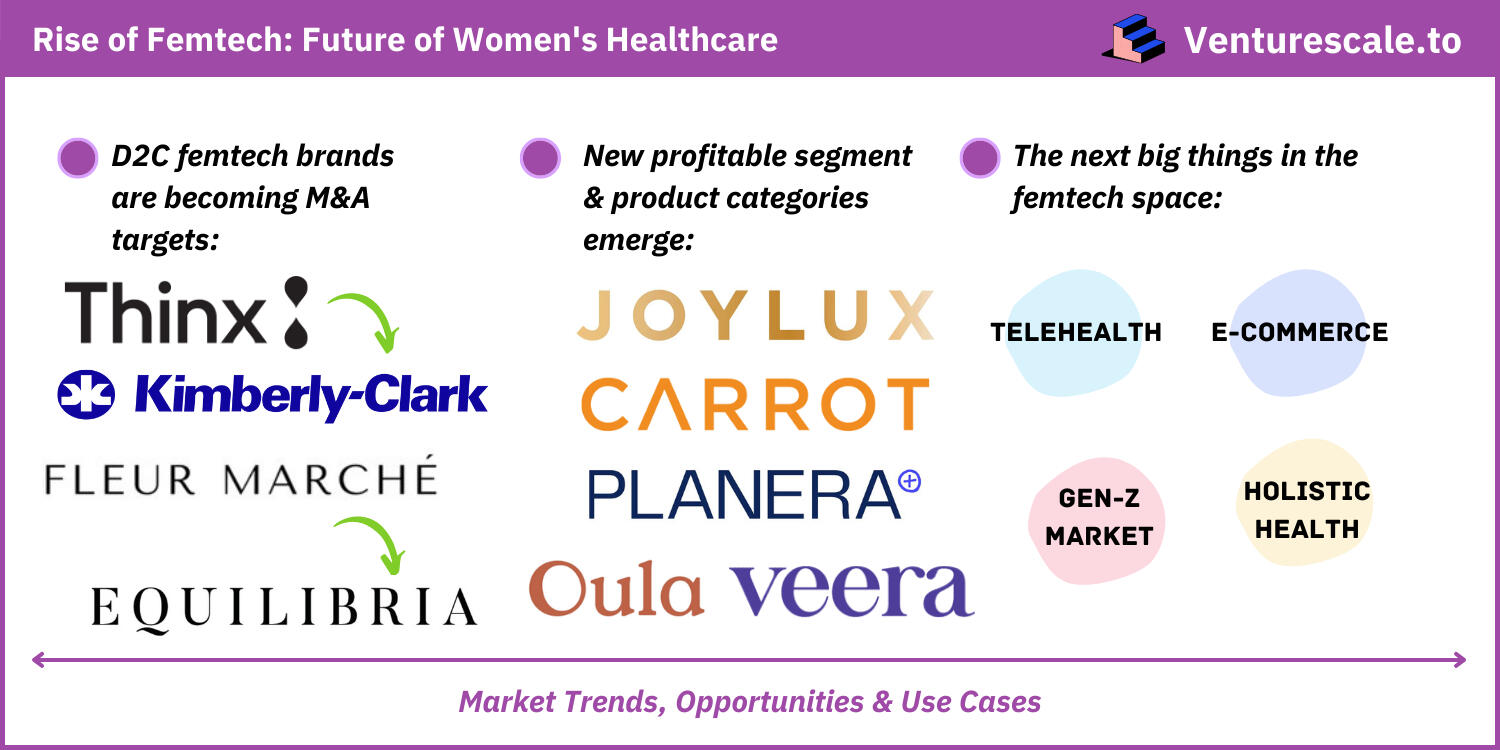

Rise of Femtech & Future of Direct-to-Consumer →

Femtech, Women's Healthcare, Women-Led Startups, Female Technology, Direct-to-Consumer, Merger & Acquisition

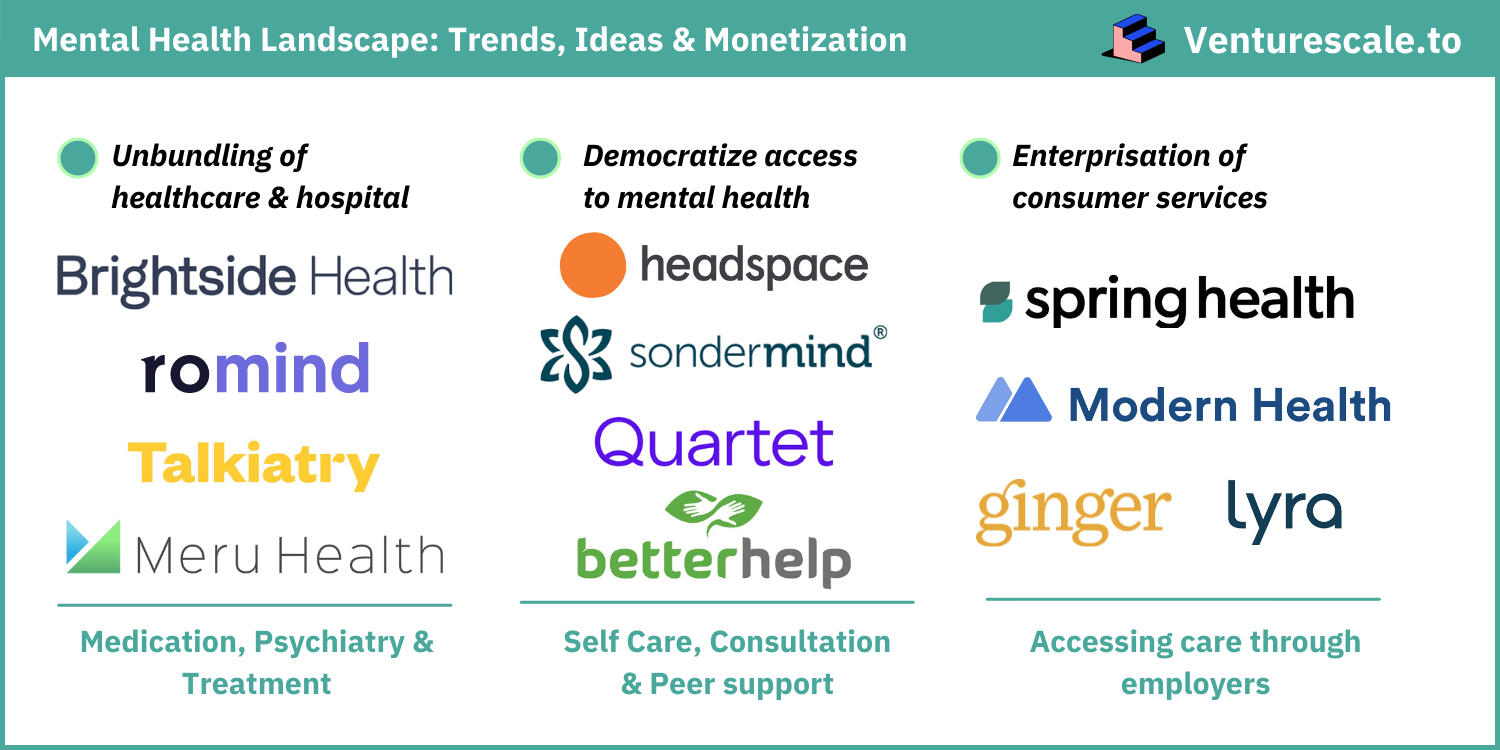

Mental Health Market Maps, Opportunities & Monetization →

Mental Health, Online Therapy, Telepsychiatry, Cognitive Behavioural Therapy, Telemedicine, Employee Mental Health, Mindfulness, Self-Care Apps, D2C Healthcare

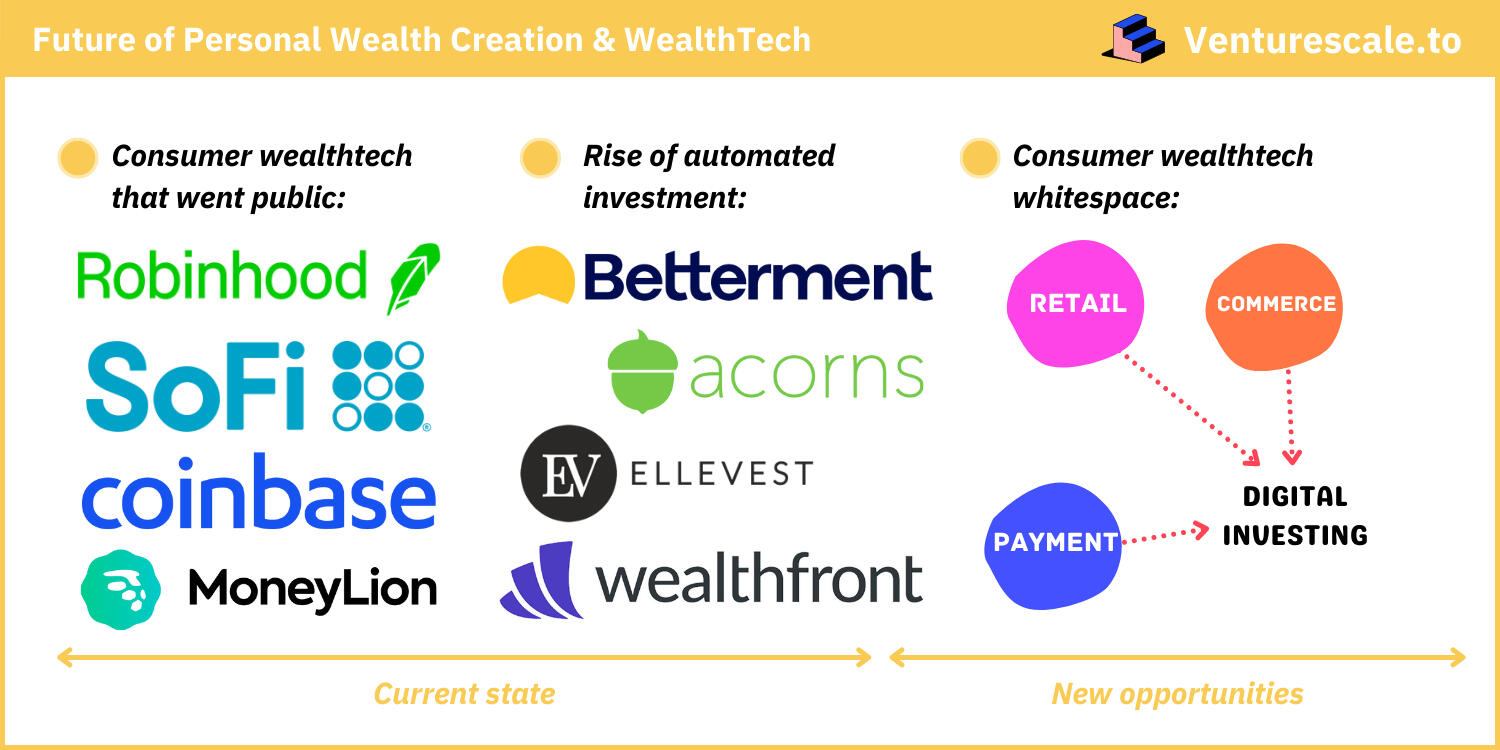

Personal Wealth Creation (Consumer FinTech)→

Fintech, Digital Wealth Management, WealthTech, Robo-Advisor, Personal Finance, Online Investing Platform, Retail Investing, Fractional Shares

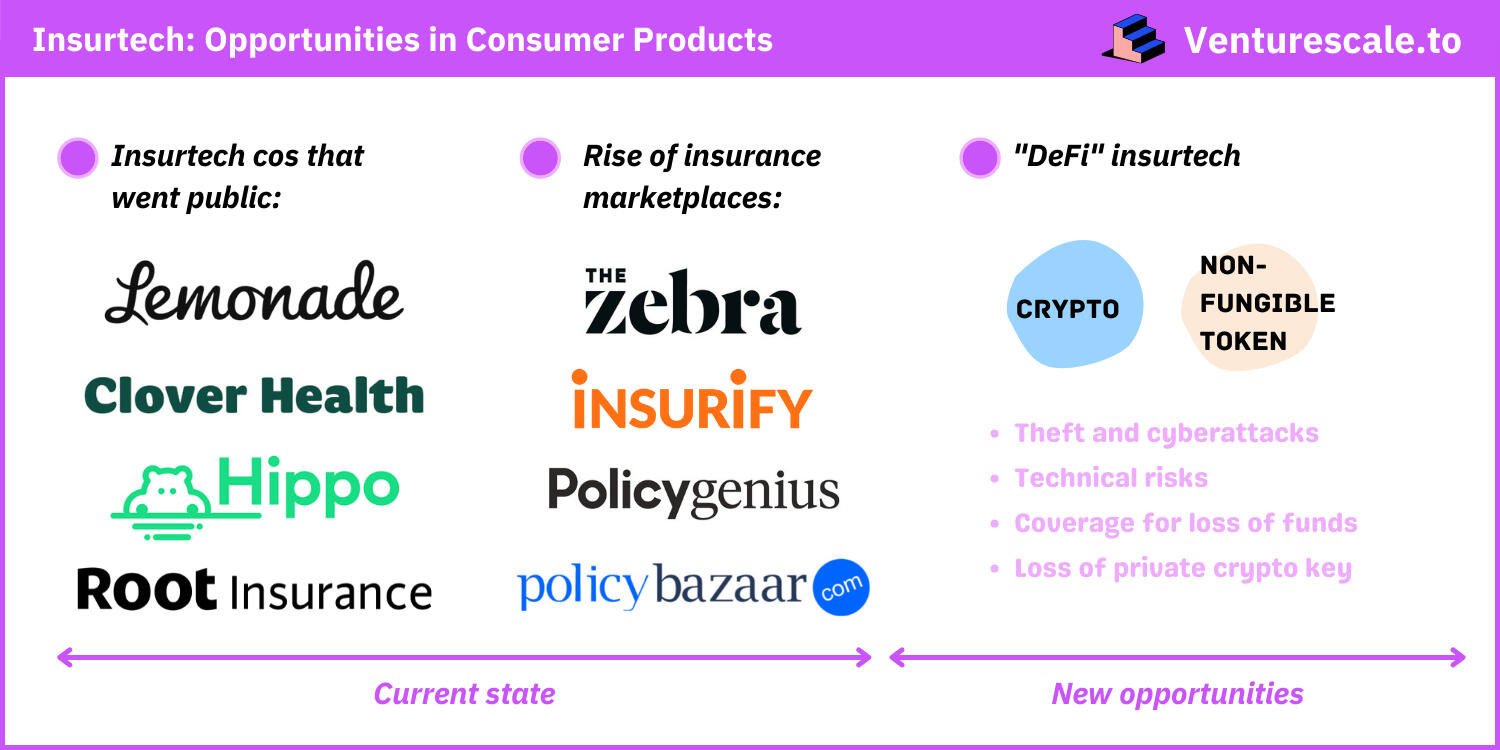

Insurtech: Opportunities in Consumer Products →

Online Insurance, FinTech, Insurtech, Insurance Marketplaces, Platform Business Models, Neoinsurance, Microinsurance

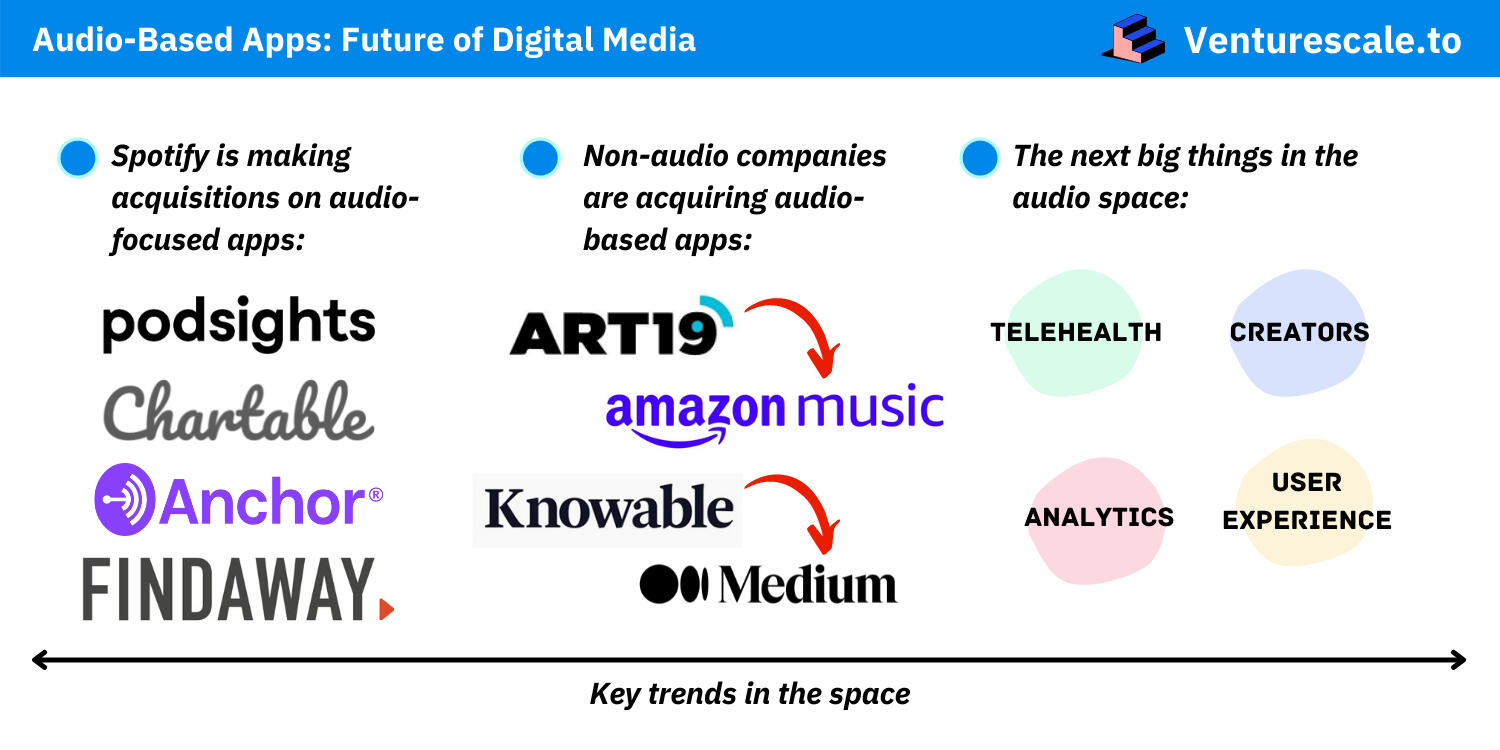

Audio-Based Creators and Content Economy →

Audio-First Apps, Live Audio, Social Audio, Online Media, Digital Media, Content Economy, Creator Economy, Podcasting Platforms

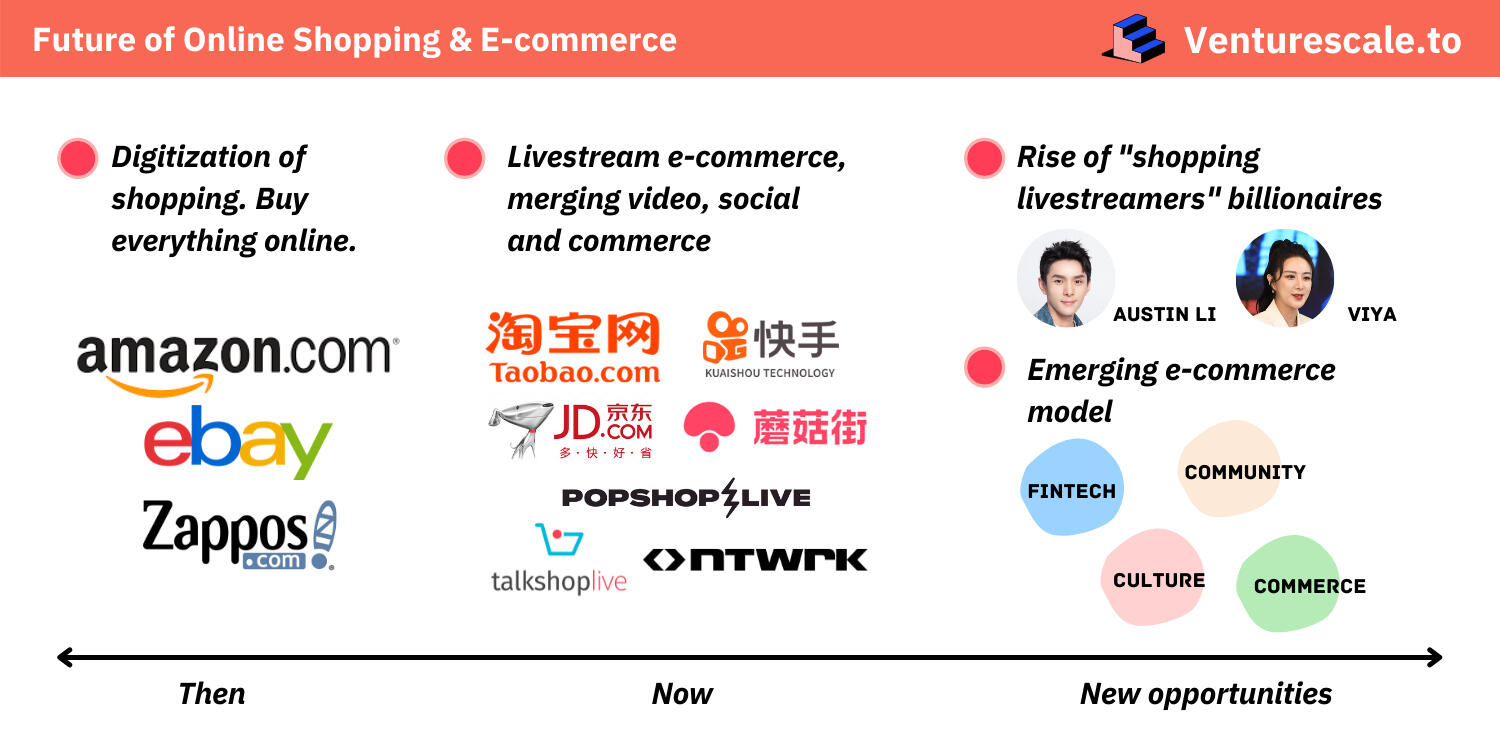

Future of Online Shopping & Ecommerce Tech →

E-commerce, Livestreaming, Social Commerce, Consumer Packaged Goods (CPG), Online Shopping, Creators Economy, Monetization

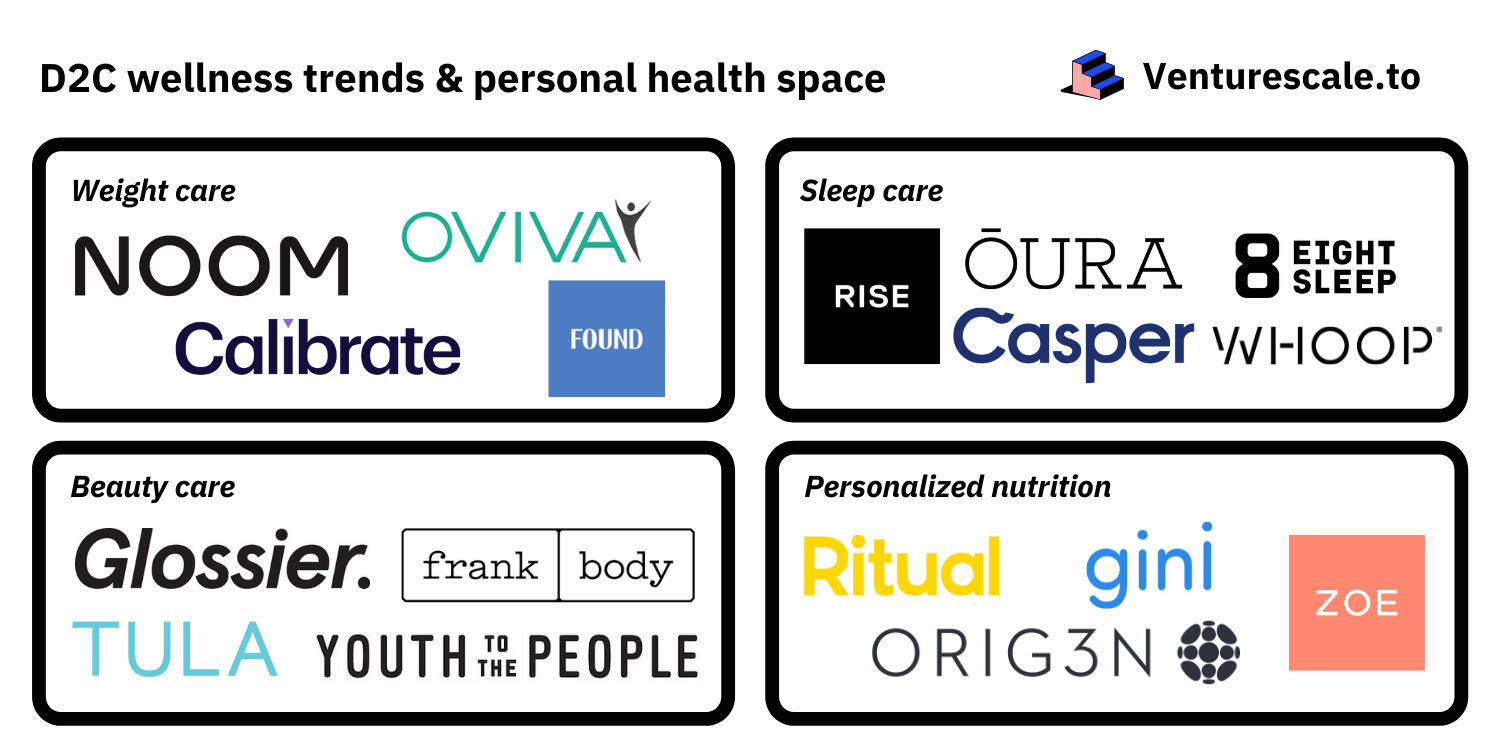

D2C Wellness: Opportunities and Monetization →

Direct-to-consumer, E-commerce, Subscription Wellness, Mental Health, Sleep Tech, Nutrition, Skincare, Personalization, Strategy

Future of Real Estate Tech & PropTech Trends →

Real Estate, Housing, PropTech, Property Marketplaces, Mortgages, Home Equity, FinTech, Business Models, Pricing, Monetization

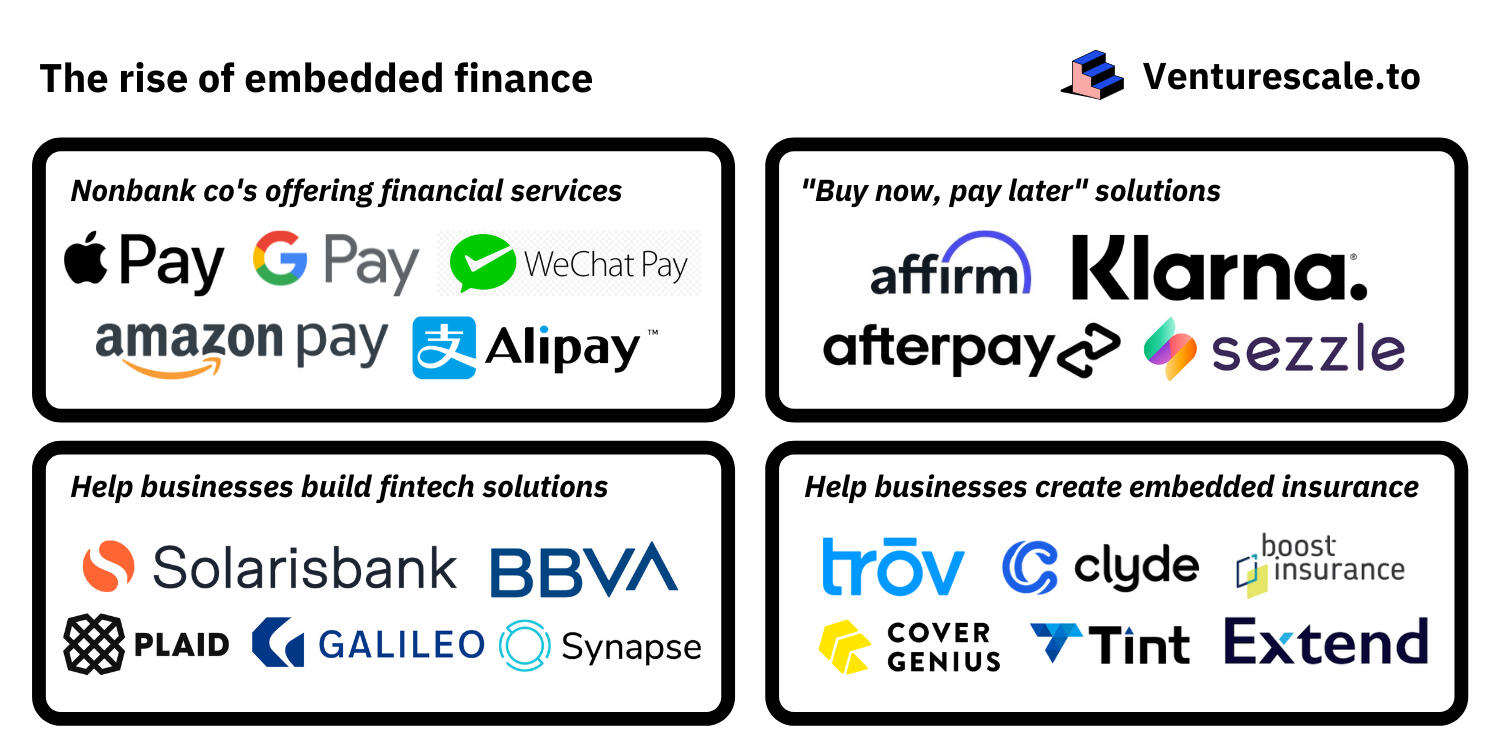

Embedded Finance & the future of Digital Monetization →

Finance, FinTech, E-Wallet, Payments, BNPL, Banking-As-A-Service, Business Models, Pricing, Monetization

Unbundling University & the Future of Education →

MOOCs, Higher Education, Upskilling, EdTech, Online Bootcamps, Lifelong Learning, D2C Education, Business Models, Monetization

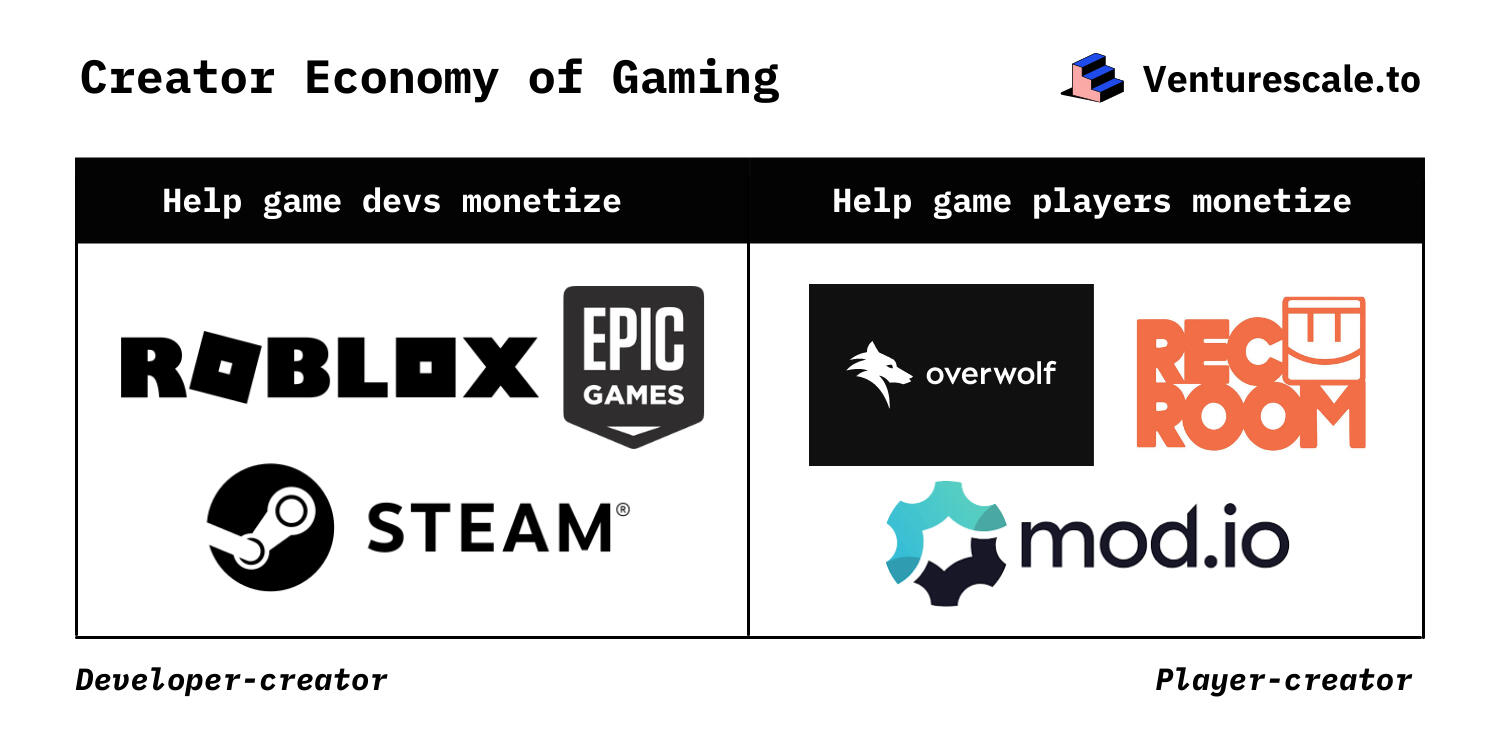

Creator economy of Gaming & Game Monetization →

Creator Economy, Gaming, Video Games, Game Creators, Player Creators, UGC, Business Models, Pricing Strategy, Monetization

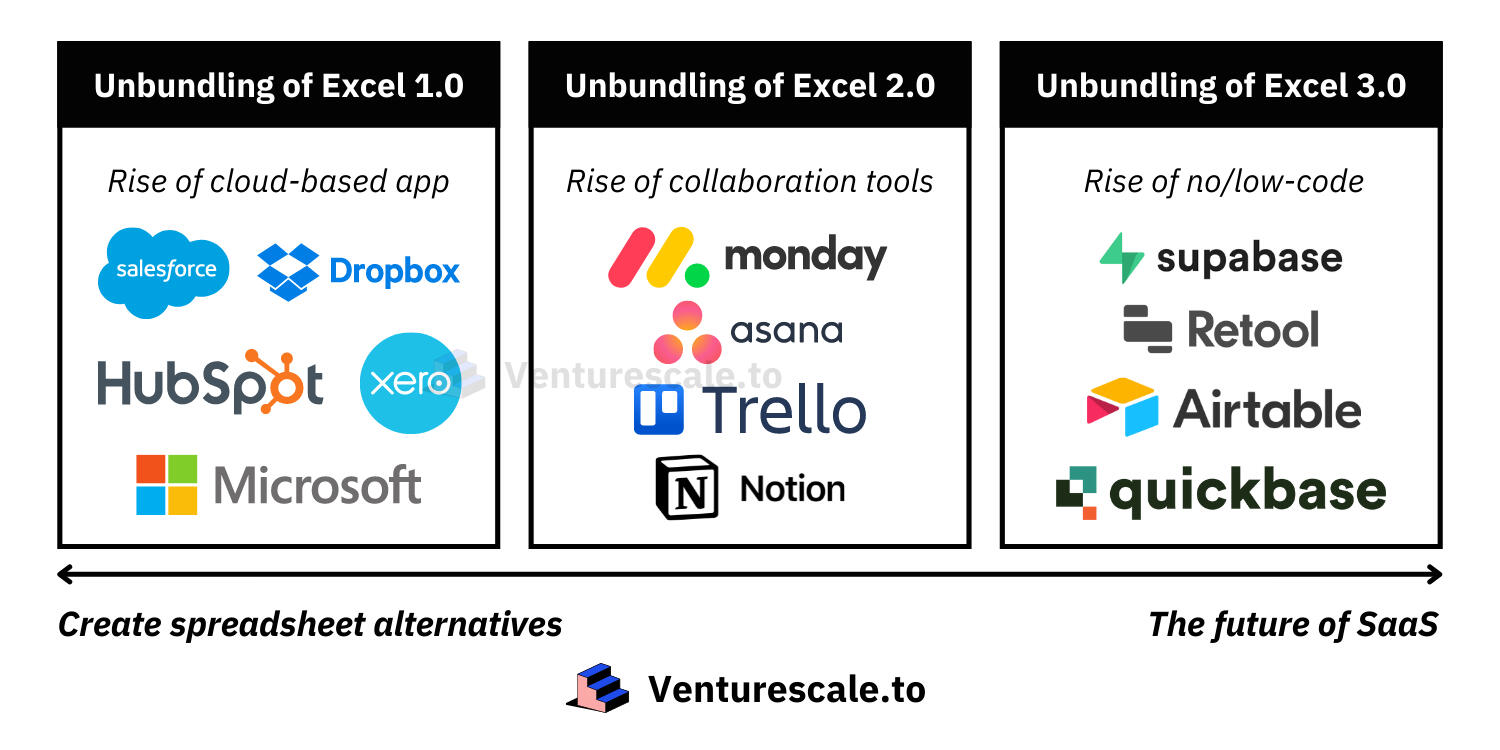

Unbundling of Excel and the Future of SaaS →

SaaS, Collaboration Tools, Cloud Solutions, No-Code, Low-Code, Business Models, Pricing Strategy, Monetization

E-commerce roll-ups and the rise of Thrasio biz model →

Private Equity, E-Commerce, Direct-to-Consumer, Acquisition Platforms, Business Models, Pricing Strategy, Monetization

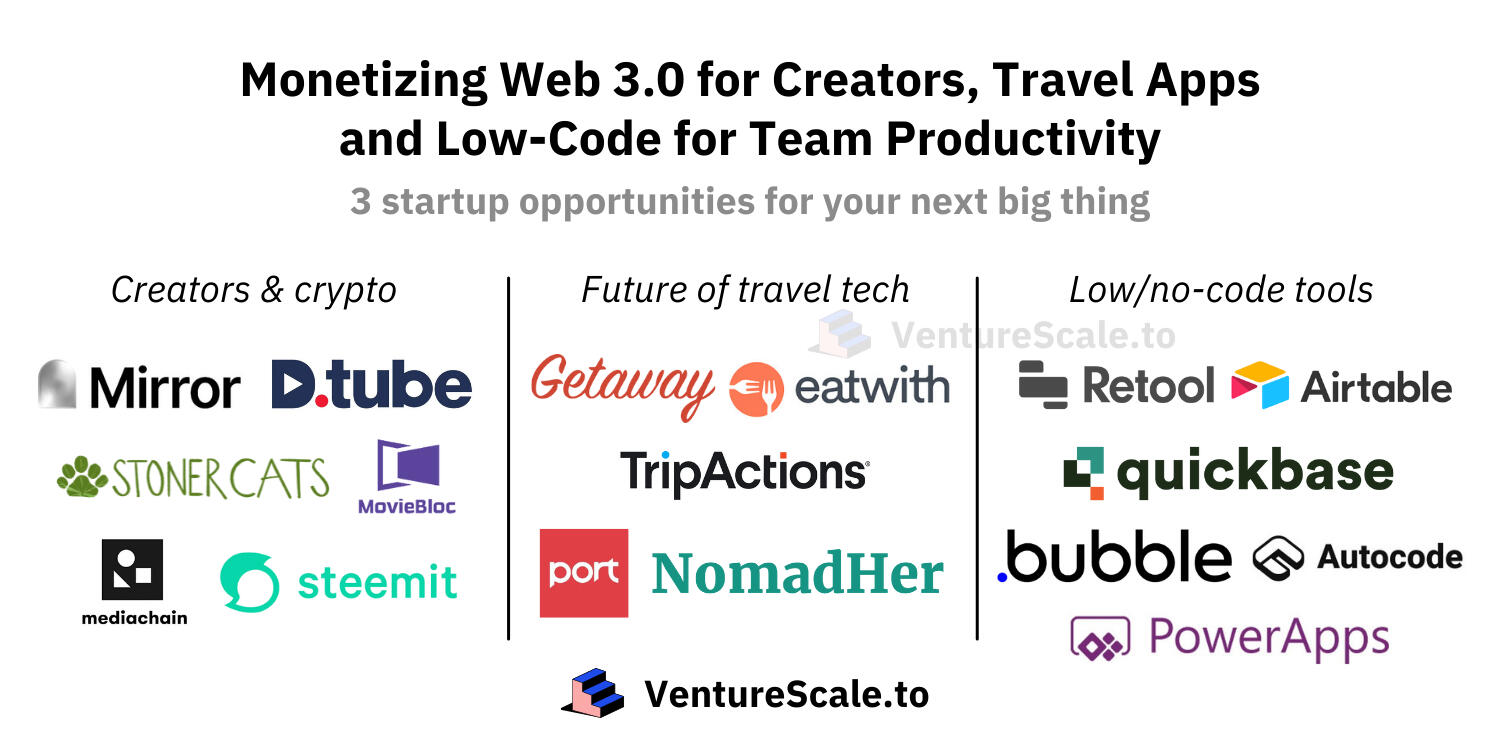

Web 3.0 for creators, Travel apps & Low-code tools →

Web3, Creator Economy, Democratization, Crypto, Travel Tech, Hospitality, SaaS, Low-Code, No-Code

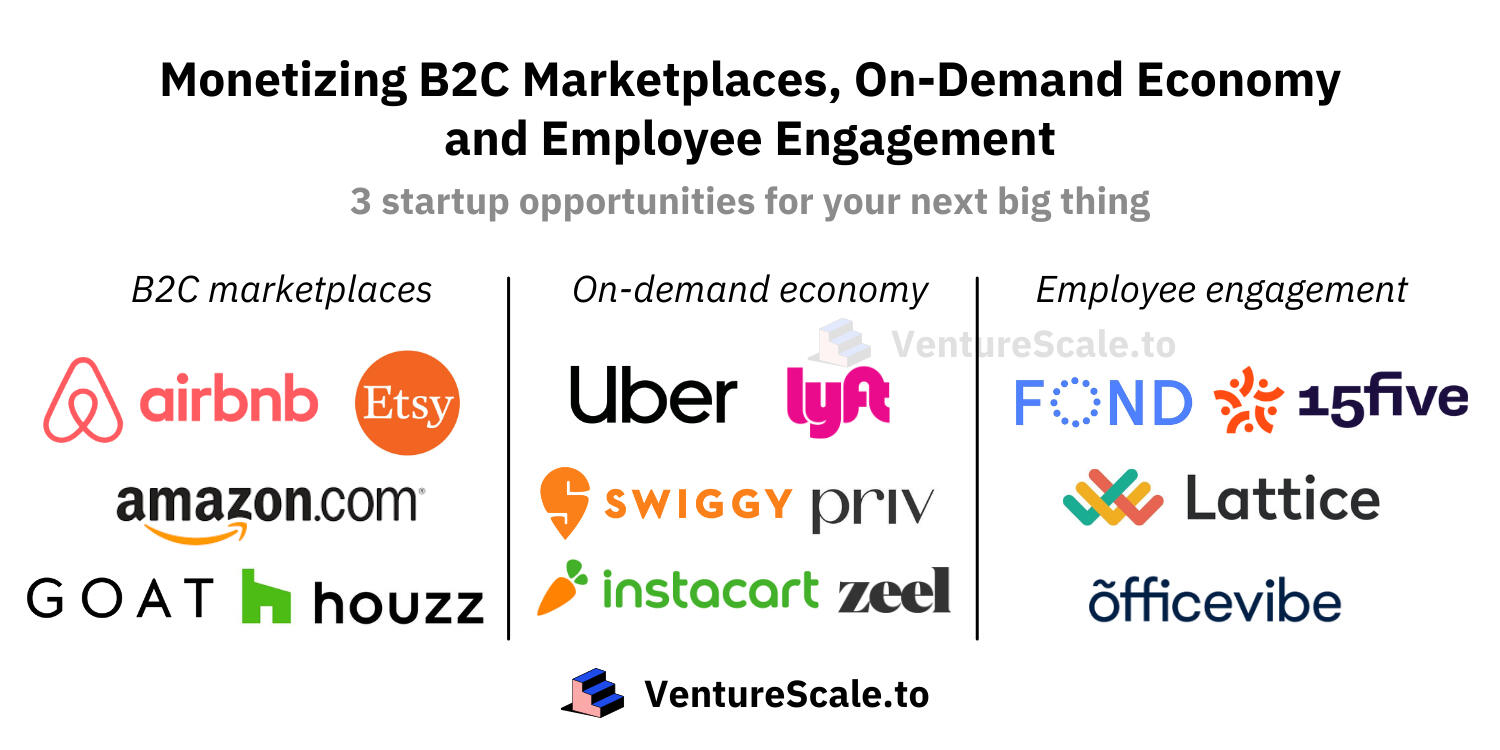

Online Marketplaces, On-Demand App & HR Tech →

Online Marketplaces, Delivery Services, E-Commerce, Mobile Apps, Human Resources, Fintech, Leadership Management

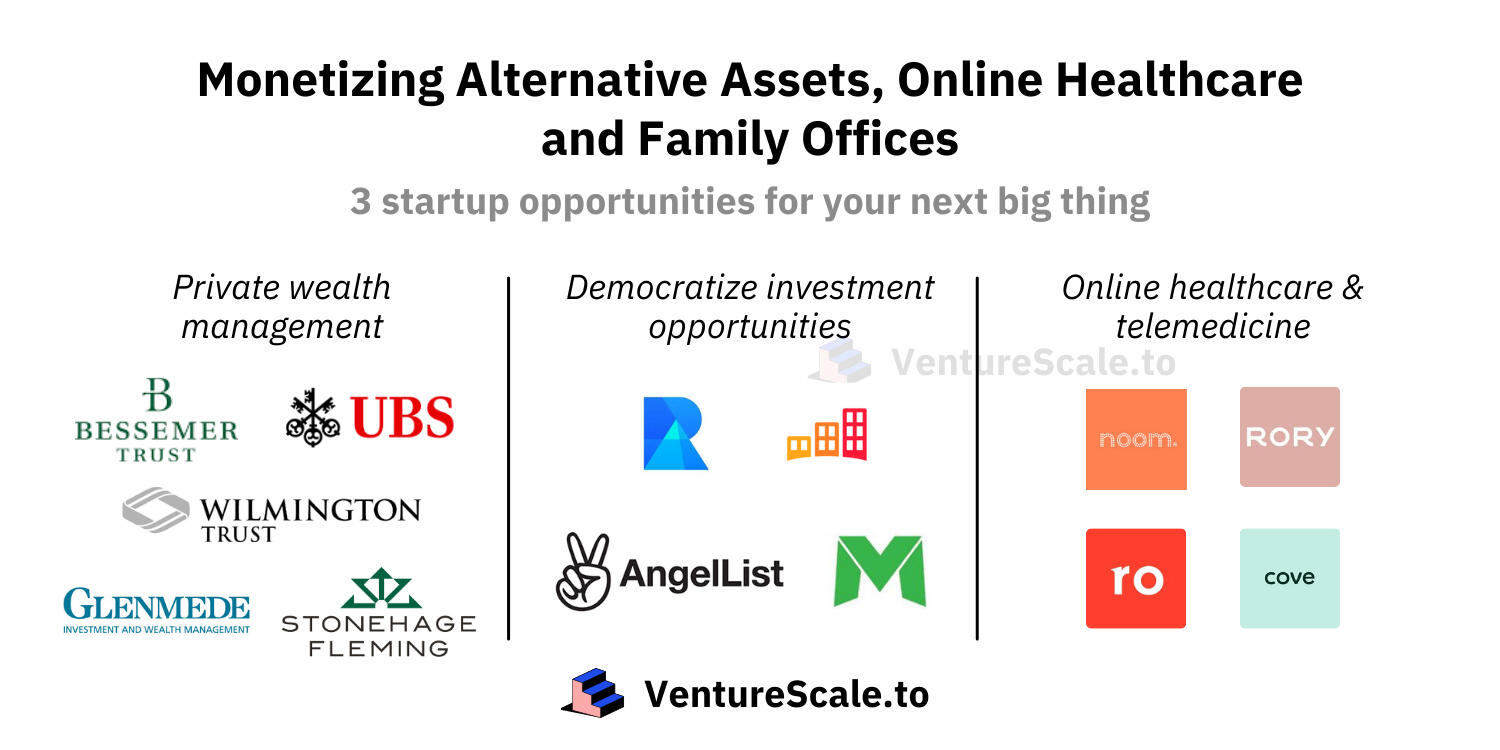

Alternative Assets, Online Healthcare & Family Offices →

Private Wealth Management, Online Wealth Management, Investing, Alternative Investment, D2C Healthcare, Direct-to-Consumer

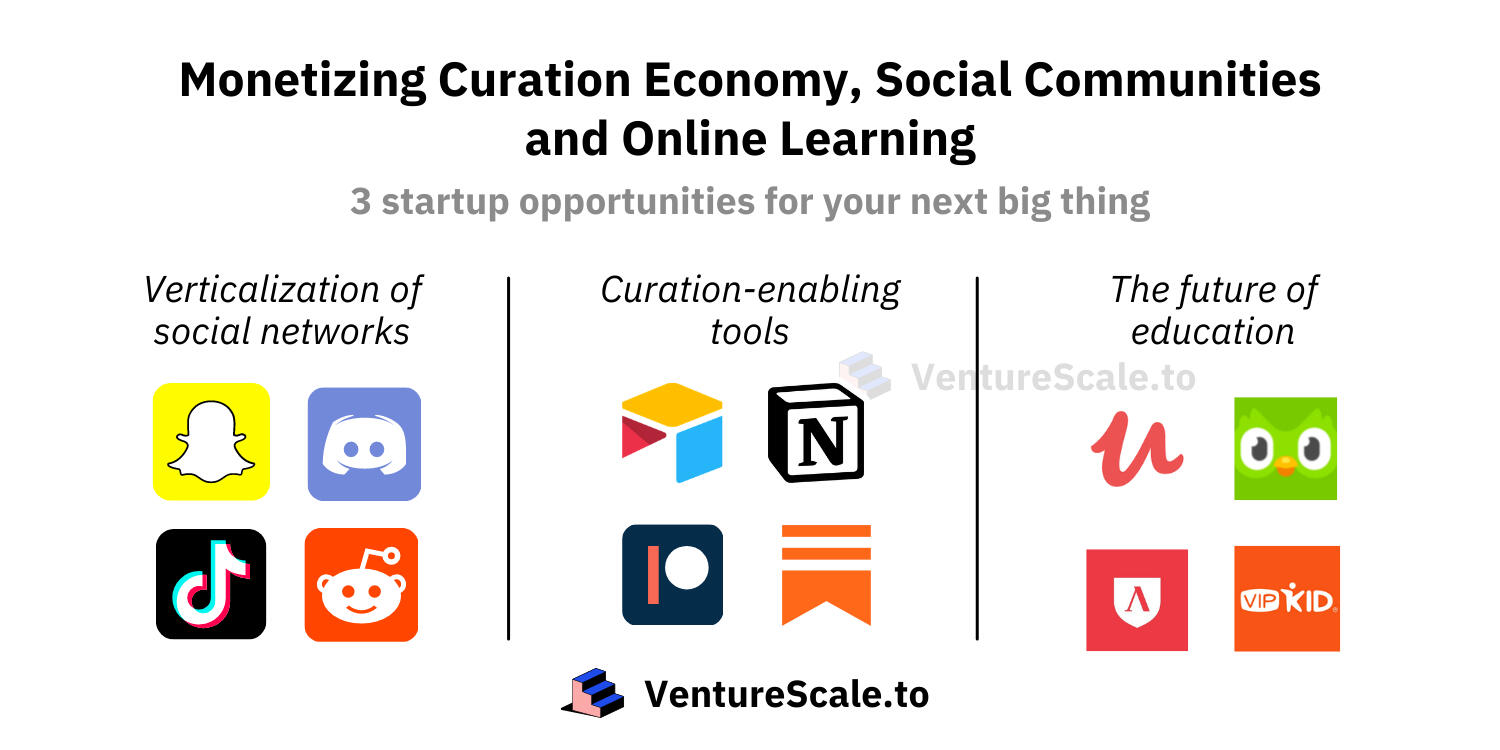

The Rise of Curation Economy & Social Communities →

Social Networks, Online Communities, Verticalization, EdTech, Online Education, Future of Social

Internet Trends Move Fast. Don't Get Left Behind!

Discover trends that shape the future of Internet products. For ongoing tech builders, venture capitalists and product innovators.

Making sense of new markets, ideas and customer needs in minutes.

Discover real-world company examples who are building in your niche.

Digestible signals and insights to help you stay on top of the tech industry.

Understand mechanisms that shape the future of Internet products.

Forget about corporate-style data, charts, and metrics in traditional market reports that take 😤FOREVER to get to the point. The new breed of tech builders want to move fast. That’s why we compressed 100 research hours into one lean report, readable in just 6.5 minutes.

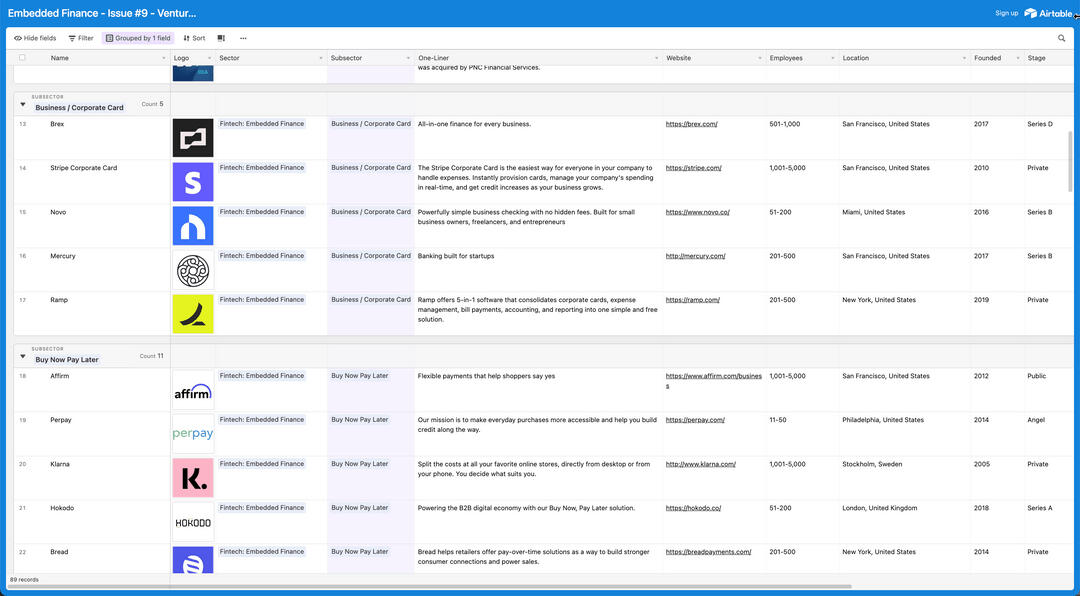

Competitor Databases

Find similar competitors in your niche. Easily sort, filter and search through the database.

3,917+ hand-picked company databases

Carefully analyzed, themed, and curated

Easily sort, filter and segment

Included in every Pro Reports (from Issue #08 to #45)

View-only database access

Content Library

One place to browse every Pro Report + Competitor Database through the online portal

What You'll Get

In summary, here's what you will receive:

Who Is It For?

For curious builders who're interested in building the future of technology products

1. Venture Investors

For investors who are scouting for the next big thing, or seeking to understand market dynamics in the tech industry.

2. Startup Founders

Helping startup founders and SaaS builders to discover profitable niche markets and innovative Internet product ideas.

3. Analysts

For analysts who are looking to form the direction of their market research and stay on top of the tech trends that define the future of Digital Age.

4. Corporate Innovators

For corporate innovators and advisors who are seeking inspiration for new product development and market expansion.

5. Company Leaders

For company leaders who aim to stay ahead of the competition, understand business opportunities, and drive their organizations towards success.

6. Product Consultants

Use Venturescale to help your clients understand how to create monetizable products by researching significant industry players.

Founder at Venturescale

I'm Zoe, the founder of Venturescale.to, and I serve as a product consultant for technology companies across the US and APAC regions.As someone who works at the intersection of Products, Markets, and Customer Problems for my clients, connecting the dots has become the purpose of my work.Naturally, this drove me to start Venturescale in 2021 to bridge the gap between new markets, product ideas, and customer needs.My philosophy behind Venturescale is simple:Venturescale is for those who are curious, open and thoughtful. Instead of information, Venturescale gives you trend anecdotes. Instead of boring data, Venturescale gives you insights and perspectives. Take the idea and run with it.I'm also the writer of Build & Launch, a newsletter that guides builders through frameworks and principles for bringing their ideas to market rapidly.Featured on well-known tech publications worldwide:

Medium Top Writer in Venture Capital, Startups & Entrepreneurship

Top 10 LinkedIn Career Influencers for early-professionals

HackerNoon Award a tech publication with 8M monthly readers

Femstreet newsletter mention: 7 Habits of Product Builders

Smart professionals "hire" a product to buy back time so they can move faster than others.

Buy Full Access

$150

/ lifetime

Ultimate Venturescale Pro Archive Library

Unlock All 45 Pro Reports

Unlock All 3,917 Competitor's Database

One-Time Payment Only

All Content Is View-Only Access

Archive Issues Only

By proceeding, you authorize THE BUILDER LAB (associated with Venturescale) to charge your payment method for the listed amount on the checkout page in USD. 🔐 Payments are securely processed by GUMROAD INC. Your credit card statement may display GUMROAD INC or THE BUILDER LAB for this transaction.

$480

/ biyearly

2 New Trend Reports Each Month

2 New Database Sets Each Month

Biyearly Recurring Subscription

Cancel Subscription Anytime

All Content Is View-Only Access

New Content & Archive Issues

We launched the Archive Library and discontinued the membership. So that we can focus on the customized research-as-a-service for our clients. If you have previously purchased any Venturescale subscription, please contact us to receive access to the Archive Library at a reduced price--or free access if you paid the yearly subscription plan.

Frequently Asked Questions

1. Where can I access my purchase?

Upon successful payment, you will get instant access to the online content portal. Please use the same email address that you used for your purchase to ensure a successful login.

2. Can I buy a single report or a portion of the report?

No. This purchase provides our customers with an 'All-Access' login to our entire content library portal, including full-access to all the reports and databases.

3. I had previously bought a Venturescale subscription

If you have previously purchased the Venturescale subscription ($100 every 3 months or $240 every year), please contact us to receive access to the Venturescale Library at a reduced price--or free access if you paid the yearly subscription plan. Simply provide us with your email address that you used during subscription, and we'll cross-reference your purchase history.

4. How often is the content in the Venturescale Library updated?

The Venturescale Archive Library contains archive issues of 45 Pro Reports and 3,917+ databases. While both the content and databases are cached and not regularly updated, our reports cover significant topics such as Artificial Intelligence (AI), SaaS, Creator Economy, and Web3.0, which will remain highly relevant for years to come. Preview all the free reports to get a sense of the relevance.

5. Will I receive any additional issues or databases as part of the Archive Library?

The Archive Library (as the product's title implies) only contains static content up to 45 reports and 3,917+ databases, with no future content added or increased.

6. Can I expense this purchase?

Yes! If you're a business owner, you can deduct it as a business expense. If you work for a company, you can get it expensed. Simply reach out to your manager by using this email template.

7. What's the refund policy?

Due to the nature of digital products and the login access granted upon purchase, we do not offer refunds for the Venturescale products. We have provided over 37+ free reports preview so that you can make clear judgement about whether you are satisfied with the product before making a purchase.

8. Can I trust the reliability of the content provided?

Yes, indeed! All content is thoroughly vetted for accuracy. We gather data from reputable public sources and offer clear, actionable insights to help you stay ahead in your industry. While we strive to ensure the accuracy and reliability of the information presented on Venturescale.to, we cannot guarantee that the data is accurate in real-time due to the fast-changing nature of the technology industry.

9. To what extent can I rely on the information?

All content provided on the Venturescale content is NOT intended as, and shall not be construed as, financial and/or startup investment advice. Please conduct your own research before making any significant financial decisions related to any of the companies mentioned in the content. We are not affiliated with any of the companies mentioned in the content. Should we have any affiliation, we will disclose it on this website. Please read the Disclaimer for more information.

10. Is Venturescale right for me?

Venturescale is designed for the new breed of VCs, founders and innovators who hate corporate-style data, charts, and metrics in traditional market reports, which often take forever to get to the point. Instead of information, Venturescale gives you trend anecdotes. Instead of boring data, Venturescale gives you insights and perspectives. However, if you care about lengthy reports, citations and charts, Venturescale is NOT the solution for you.

Smart professionals "hire" a product to buy back time so they can move faster than others.

Buy Full Access

$150

/ lifetime

Ultimate Venturescale Pro Archive Library

Unlock All 45 Pro Reports

Unlock All 3,917 Competitor's Database

One-Time Payment Only

All Content Is View-Only Access

Archive Issues Only

By proceeding, you authorize THE BUILDER LAB (associated with Venturescale) to charge your payment method for the listed amount on the checkout page in USD. 🔐 Payments are securely processed by GUMROAD INC. Your credit card statement may display GUMROAD INC or THE BUILDER LAB for this transaction.

$480

/ biyearly

2 New Trend Reports Each Month

2 New Database Sets Each Month

Biyearly Recurring Subscription

Cancel Subscription Anytime

All Content Is View-Only Access

New Content & Archive Issues

We launched the Archive Library and discontinued the membership. So that we can focus on the customized research-as-a-service for our clients. If you have previously purchased any Venturescale subscription, please contact us to receive access to the Archive Library at a reduced price--or free access if you paid the yearly subscription plan.